The price action showed there was a possibility of a bullish reversal for Bitcoin, but the on-chain metrics showed a wave of selling was around the corner.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The market structure was bearish but the downward momentum has weakened.

- The liquidity pocket above $30k presented an attractive target for a short squeeze.

The FOMC announcement of a 25-bps hike did not induce a sharp move for Bitcoin [BTC] suggesting the event was priced in. The past few days saw scant volatility and volume, but the market structure favored the bears.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Since the past few days did not see BTC move lower, short positions opened after the move beneath the range lows were vulnerable to a squeeze. Bitcoin’s static price action after the move below $29.8k suggested such a squeeze, or even a bullish reversal, could be on the cards.

The breakdown beneath the range did not see sustained selling pressure

The RSI was below neutral 50 to signal bears were still in control on the 1-day timeframe. The OBV slipped beneath a support level from earlier in July. The price has made a lower low, and the indicators agreed with the bearish outlook.

Although there are imbalances left lower on the charts after the pumps Bitcoin saw in June, it was unclear if the bears can force a move that far south. The hype around BlackRock, Fidelity, and other Bitcoin ETF applicants last month failed to push prices higher. This hinted at a shift in sentiment.

Hence, until Bitcoin can close a daily session above $30.5k and hold that zone as support for another day or two, bears would be the more dominant force in the market. On the lower timeframes, a move higher to collect liquidity at the $30k-$30.5k was possible. Such a bounce can be used to enter short positions targeting the $28.5k and $27.3k support levels.

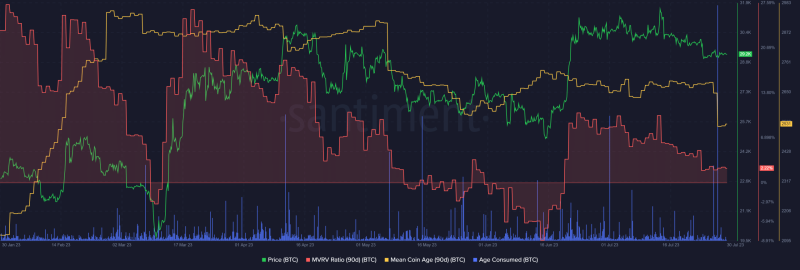

The large spike in Bitcoin age consumed metric could be ominous

The 90-day MVRV ratio was slowly sinking. This meant selling pressure from profit takers would be diminished in the coming days. Yet, the mean coin age took a tumble on 27 July. This was evidence of increased movement of BTC between addresses and an uptick in seller activity.

Is your portfolio green? Check the Bitcoin Profit Calculator

It was followed by a massive spike in the age consumed metric, whose inference was that a sizeable amount of previously idle BTC was on the move.

These developments were a strong signal that a huge wave of selling could be imminent. Risk-averse buyers can wait for conditions to change before seeking buying opportunities.