Contents

Definition

Run rate is a company's projected financial results based on current financial data.

Key Takeaways

- The run rate uses current financial data to estimate the future performance of a company.

- It can be used by investors, business owners, analysts, and advisors to make executive decisions.

- Using the run rate is most relevant when analyzing new companies or newly launched products.

- It is not a reliable number for one-off sales campaigns and companies with seasonal sales revenue.

- Always consider the context of the company and the type of company you are analyzing when calculating its run rate.

Definition and Examples of Run Rate

Whether you’re a business owner, investor, analyst or advisor, understanding what the run rate of a company is can be an invaluable tool. By taking a company’s current financial data and multiplying it by a given period, you can get an estimated projection of that company's future growth. The run rate is often used for a company that has been in business for a short period.

- Alternate name: Revenue run rate

Let’s say a venture capital company is analyzing the projected growth of a potential investment, ABC Software, Inc. ABC Software is a startup that has only been in business for four months, which means it has little to no historical financials to analyze its growth projections. It has consistently produced at least $100,000 in revenue per month thus far.

The venture capital firm decides to use a run rate to project the future performance of ABC Software, Inc. It takes the $100,000 monthly revenue and multiplies it by 12 months to estimate that the annual performance will be approximately $1.2 million.

This same concept applies to a company that may be launching a new product, service, or department to expand the company. Decision-makers of a company can take the current financial numbers of the respective product, service, or department, and calculate a run rate to estimate future performance.

Note

The run rate assumes current conditions will continue. For example, it assumes that if a company made $100,000 in one month, it’ll likely make that amount every month for the rest of the year. If that is not the case, the run rate may be misleading.

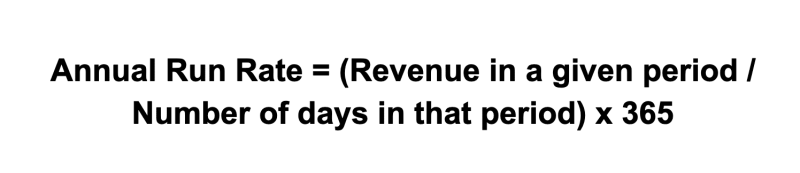

How To Calculate Run Rate

To calculate a company’s run rate, simply take the revenue of the company in a given time frame and divide that by the number of days in that period. Next, multiply that number by 365 to get the annual run rate. Here’s what the formula looks like:

For example, if Company BSL had revenue of $900,000 in the first quarter of the year, you’d first divide that by the number of days in that quarter (900,000 / 90 = 10,000). You’d then multiply that by 365 to get the annual run rate of $3.65 million.

You can also calculate the run rate by taking the current revenue for one month and multiplying it by 12, to get the annual run rate:

- Annual Run Rate = 1 month of revenue x 12 months

For example, if Company HWG had revenue of $500,000 in January, you’d multiply that number by 12 to get the annual run rate of $6 million.

Pros and Cons of Run Rate

Pros

-

May be useful for new companies

-

Better for projecting long-term sales contracts or newly launched products

Cons

-

May be unreliable for companies with seasonal revenue

-

Irrelevant for estimating one-off product sales

Pros Explained

- May be useful for new companies: Companies with no earnings track record don’t have much information to use to create projections and financial forecasts. Using the run rate can be a great starting point to project how a company will likely perform in the future.

- Better for projecting long-term sales contracts or newly launched products: Products that have long-term contracts make a run rate even more accurate. Why? Because contracts give stability to estimated future revenues. Newly launched products have little historical data to use; thus, a run rate is ideal in forecasting sales.

Cons Explained

- May be unreliable for companies with seasonal revenue: Seasonal revenue means the annualized numbers will be inaccurate because sales may vary from month to month. For example, let’s say a winter-sports-apparel company does more business in the winter than in the summer. If we were to use the sales numbers during a high-producing month to calculate the run rate for the business, it wouldn’t be reliable because we know that sales are only this high during the winter months. That annual run rate would likely be incorrect.

- Irrelevant for estimating one-off product sales: If a company decides to sell a product for only a short time frame with no plans of selling that product next year, then the run rate would be irrelevant since the product would not exist in the future.

What It Means for Investors

The run rate can help you determine if a company will likely be profitable in the long term. This may be helpful in deciding whether or not to invest in a company. If you calculate the run rate and it shows the company will bring in revenue, you may want to invest in it early to profit from that success. Since run rate is most applicable to newer companies, though, you’d likely be investing in a startup. The run rate is just one component in deciding if the business will be profitable, so be sure to weigh all of the risks, and never invest money that you can’t afford to potentially lose.

Was this page helpful? Thanks for your feedback! Tell us why! Other Submit