“Digital asset investment products saw inflows for the second week totalling US$78m, while trading volumes for ETPs also rose by 37% to US$1.13bn for the week,” CoinShares declared.

Crypto Inflows on the Rise Despite Lacklustre Ethereum ETF Launch

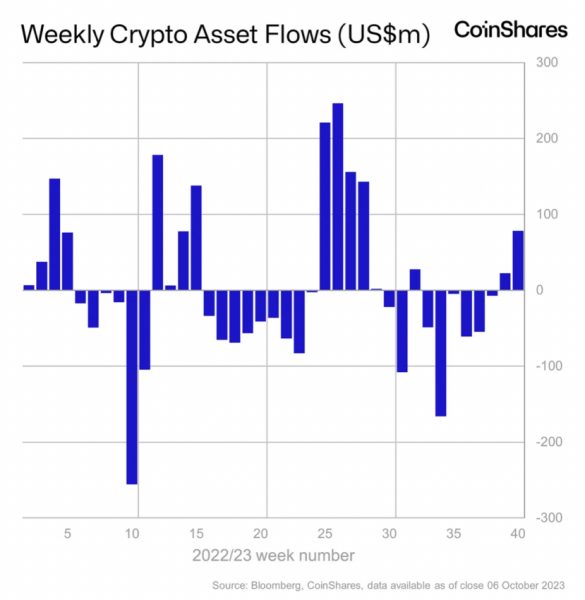

According to a recent report by Coinshares, the crypto market experienced the most significant inflows surge since July over seven consecutive days from September 30 to October 6.

Inflows refer to the quantity of crypto that has entered the market during a specific timeframe. During the previous week, a total of $78 million worth of cryptocurrency flowed into the market.

Weekly Crypto Asset Flows. Source: CoinShares

However, it noted that last week’s launch of Ethereum Futures-based exchange-traded funds (ETFs) fell short of the anticipated significant market impact:

“The Ethereum futures ETF launches in the US attracted just under US$10m in the first week, highlighting a tepid appetite.”

Meanwhile, higher crypto inflows have been directly correlated with the submission of Bitcoin ETF applications expected throughout this year.

BeInCrypto reported on June 26 that the filing of BlackRock’s Bitcoin ETF had a notable effect, driving crypto inflows to reach $199 million over the seven-day period.

Crypto Market Welcomes Inflows Following Multiple Outflows

On the other hand, Solana witnessed a rapid surge in inflows, achieving its highest levels since March 2022. It recorded weekly inflows of $24 million, solidifying its position as the “altcoin of choice.”

On October 2, BeInCrypto reported that Solana’s total value locked (TVL) hit a new 2023 all-time high of $338.82 million.

However, the crypto community is abuzz with speculation over Solana, as the estate of the now-defunct crypto exchange FTX has obtained approval to liquidate its crypto holdings. The estate holds approximately $1.2 billion worth of SOL.

At the time of publication, SOL’s price is $22.15.

Solana Price Chart 1 Month. Source: BeInCrypto

Just last week, CoinShares marked net positive inflows in the crypto market for the first time in six weeks, amounting to $21 million.

In the preceding week, there were outflows totaling $9 million.

As per CoinShares’ data, European investors are said to have added $16 million in inflows for the week ending September 22, whereas US investors pulled out $14 million.