Dogecoin broke out of a bearish pattern, one that pushed the memecoin’s price down significantly.

Edited By: Jibin Mathew George

- DOGE’s price dropped by more than 8% in the last 24 hours

- One market indicator hinted at a trend reversal soon

Dogecoin [DOGE] recorded a major price correction on the charts in the last 24 hours. While DOGE did follow Bitcoin’s own depreciation, a bearish pattern might have contributed to the memecoin’s devaluation too. Ergo, let’s take a closer look at what’s going on with DOGE.

Dogecoin’s latest disaster

DOGE bears pushed the bulls aside as the token’s value dropped significantly. According to CoinMarketCap, DOGE’s price dropped by more than 8% in the last 24 hours. At the time of writing, the memecoin was trading at $0.1476 with a market capitalization of over $21 billion, making it the 8th largest crypto.

AMBCrypto’s analysis found that this recent unprecedented drop was not unforeseen. We found that DOGE was already moving inside a rising wedge pattern, which usually results in a price decline. To be specific, DOGE started to move inside the bearish pattern since the beginning of May, and it made its bearish breakout yesterday.

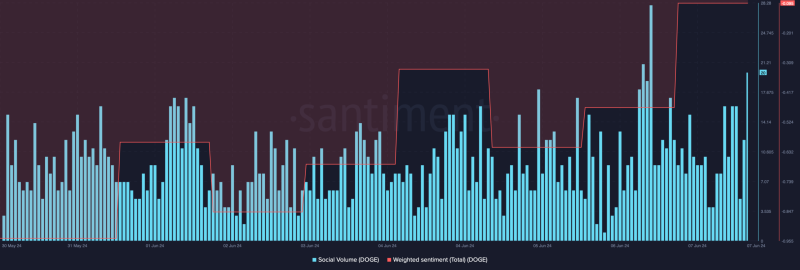

Since DOGE’s price lost substantial value, people started to talk about the memecoin, which was evident from the rise in its weighted sentiment. However, it was surprising to note that while the memecoin’s price dropped, its weighted sentiment improved. This meant that bullish sentiment around Dogecoin increased over the last few days.

Is DOGE awaiting a trend reversal?

AMBCrypto then had a closer look at DOGE’s state to better understand whether the rise in weighted sentiment would result in a trend reversal.

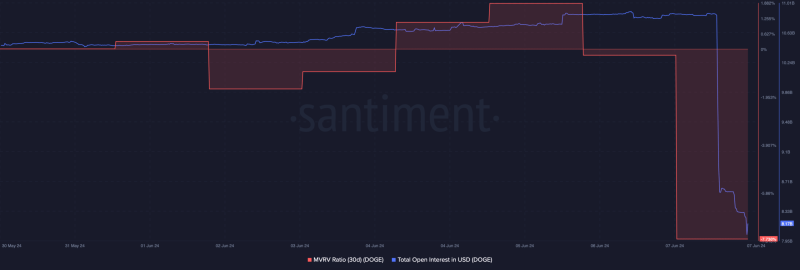

As per our analysis, DOGE’s weighted sentiment dropped sharply, which can be inferred as a bearish metric. Nonetheless, its open interest also dropped along with its price. Whenever open interest drops, it indicates that the chances of a trend reversal are high.

We then analyzed the memecoin’s 12-hour chart to better understand which way it may be headed.

The technical indicator MACD displayed a bearish crossover. Its Relative Strength Index (RSI) registered a sharp downtick. Additionally, the Money Flow Index (MFI) also followed the RSI and moved south. These indicators hinted at a further price drop on the charts.

If that happens, then investors might see DOGE drop to $0.147. A fall under that level could result in Dogecoin dropping to $0.130.

Nonetheless, the Chaikin Money Flow (CMF) seemed pretty bullish on the memecoin and indicated a possible trend reversal.

If that turns out to be true, then DO GE might rebound soon and hit $0.174 in the coming days or weeks.