The pilot, conducted with the Monetary Authority of Singapore (MAS), follows UBS’ successful tokenization of bonds and structured notes in the past year. According to the head of UBS Asset Management’s regional head, Thomas Kaegi, tokenization improves liquidity and access to financial products.

Tokenization Improves Asset Liquidity, Says UBS

“This is a key milestone in understanding the tokenization of funds, building on UBS’s expertise in tokenizing bonds and structured products. Through this exploratory initiative, we will work with traditional financial institutions and fintech providers to help understand how to improve market liquidity and market access for clients.”

UBS’s test is part of Project Guardian, a MAS experiment to test the potential of a market that Citi says could grow to trillions of dollars by 2030. Last year, MAS partnered with DBS Bank and JPMorgan to exchange tokenized currencies through a permissioned pool smart contract.

Tokenization encodes digital or physical asset ownership according to a standard compatible with one or more private or public blockchains. Parties can exchange tokenized assets quicker than traditional payment networks, which improves liquidity.

According to several experts who spoke to BeInCrypto, tokenization may yet take years to become mainstream. William Quigley, the co-founder of USDT, expects tokenization businesses to spring up around 2024 and 2025 but admits that issues around asset possession and ownership still need clarity.

Danny Chong, the CEO of Tranchess, a decentralized finance platform, said the technology needs rules on how asset transfers would occur in practice. If a car is tokenized, for example, the parties need rules on how the physical transfer of the asset could occur, as well as how the different parties would pay their taxes.

Investment Market Boom Bodes Well for Tokenization

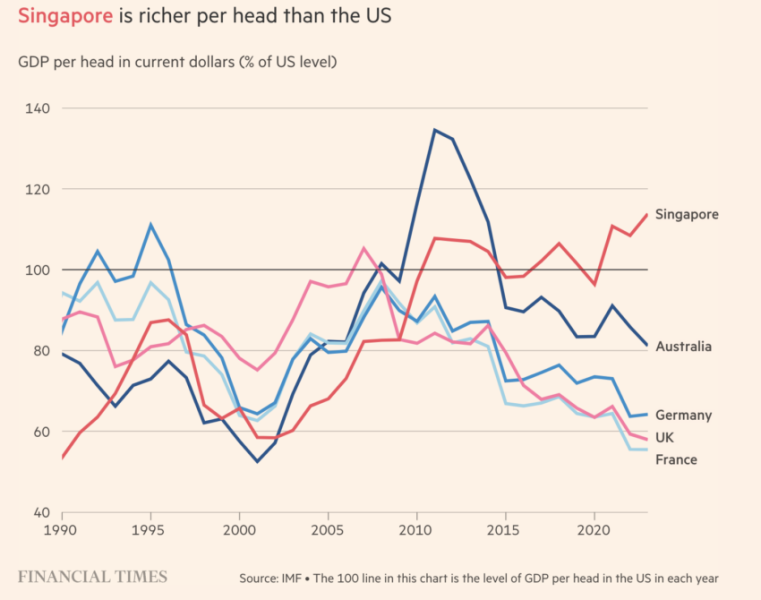

But if a region is likely to lead rulemaking, Singapore may be as good a candidate as any. The sheer volume of foreign investments has pushed Singapore’s gross domestic product (GDP) per head above the US for most of the last decade.

GDP Per Capita | Source: Financial Times

Former leader Lee Kuan Yew used low taxes and subsidies to attract foreign investors after securing independence from Malaysia. Lee’s regime was characterized by the rapid adoption of cutting-edge technologies, a legacy continued by successors Goh Chok Tong and Lee Hsien Loong.

Despite initially opposing retail crypto investing, the MAS has slowly warmed to blockchain technologies. In addition to Project Guardian, it recently proposed a new framework around stablecoins, which are tokenized representations of traditional currencies that can be exchanged across blockchains.

This commitment to progress and the city’s increasing attractiveness as an investment destination may see rapid adoption of tokenization. The city-state attracted $195 billion from foreign investors last year, a flood of inflows that shows no signs of slowing.

According to Parag Khanna of global strategic advisory firm FutureMap, the tsunami is unlikely to abate anytime soon.

“The money is pouring in.”