10 Years of Decentralizing the Future

May 29-31, 2024 – Austin, TexasThe biggest and most established global hub for everything crypto, blockchain and Web3.Register Now

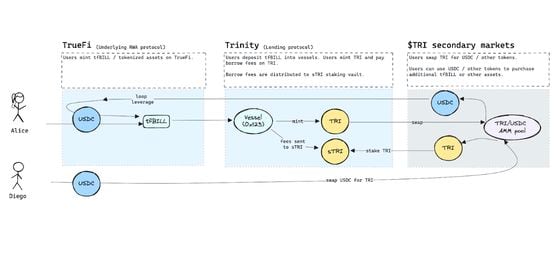

- Investors will be able to deposit TrueFi’s T-bill token to borrow the platform’s new TRI token.

- TRI holders will be able to stake the token to earn a yield from borrowing fees.

- The offering comes as DeFi activity and demand for leverage picked up amid the current crypto bull market.

Unmute

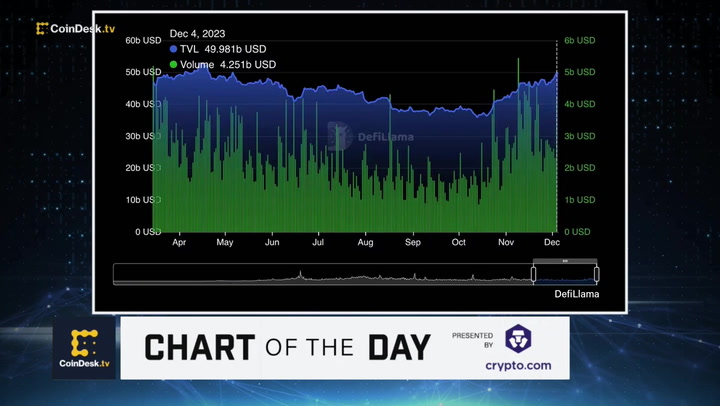

01:11DeFi Market Rebounds to $50B as Speculators Hunt for Yield

11:05How Spool Is Aiming to Help Institutions Enter DeFi

01:27Curve Finance’s Stablecoin Maintains Peg as Others Struggle: Kaiko

03:20DeFi's Total Value Locked Slumps to Lowest Level Since February 2021: Data

Decentralized finance (DeFi) lender TrueFi unveiled plans Monday to start a real-world-asset-based (RWA) lending platform called Trinity to boost utility for its tokenized U.S. Treasury offering.

Trinity will let users take out crypto loans using tokenized RWAs as collateral. TrueFi’s Treasury bill token (tfBILL) will be the first, with plans to add other yield-generating tokenized products in the future, according to a TrueFi governance proposal by ecosystem developer organization Wallfacer Labs.

Investors will be able to borrow the platform’s TRI token by pledging the tfBILL tokens, using the borrowed crypto to create DeFi strategies to earn up to 15% annualized yield, the proposal said. Investors will also be able to buy TRI tokens on secondary markets such as decentralized exchanges, and stake them to earn a yield from the platform’s borrowing fees.

The proposal to launch Trinity is pending approval by the TrueFi decentralized autonomous organization.

The proposed new platform follows a resurgence in DeFi activity in recent months, with crypto-native yields and demand for leverage rapidly increasing amid the roaring digital asset bull market. The CoinDesk 20 Index, a measure of the most liquid crypto tokens, has risen almost 50% since the start of the year.

TrueFi was a key lender during the previous crypto bull cycle, originating over $1.5 billion of undercollateralized loans mainly to trading firms and market makers. As crypto prices cratered in 2022 with multiple firms imploding, some borrowers failed to repay their loans and depositors fled. The protocol’s total value locked dropped to $20 million by the end of 2022 from a peak of over $900 million in 2021.

Last year, TrueFi introduced the tokenized U.S. Treasury offering, which had recently attracted $8.7 million of deposits.

TrueFi’s governance token (TRU) jumped 14% after the proposal was published at 15:53 UTC, and has gained some 20% in the past 24 hours.

Edited by Sheldon Reback.