Contents

Orica NFT’s charity efforts have succeeded, but its tokenholders have not, and up until now, its co-founder was nowhere to be found.

Launched in November 2021, nonfungible token (NFT) marketplace Orica held itself up as an “ethical platform” benefitting artists, collectors and charities alike. At the time, the organization was involved in prominent projects — from building a school in Uganda to aiding victims of human trafficking to helping Ukraine.

But less than two years later, the project’s founders have disappeared, and the marketplace’s user interface has gone offline. All that remains are the project’s charity efforts, which proved to be genuine, in tandem with allegations from disgruntled users that the developers orchestrated a rug pull. In a new revelation, co-founder Danial Zey breaks his yearlong silence, not only denying all allegations and insisting the project was “hacked” but also claiming that the project is still ongoing. Cointelegraph investigates.

An ICO amid the bear market

According to initial coin offering (ICO) information site CryptoTotem, Orica ran a fundraiser from Aug. 14 to Sept. 14, 2021. It aimed to raise $3.1 million from the sale of its Orica (ORI) token. In its ICO, Orica promised to earmark 50% of the total supply of ORI for “NFT marketplace rewards.” Another 10% was supposed to be supplied to “advisors and partners,” 15% given to the team and 25% sold to investors. At launch, Aug. 21, 2021, the price of ORI rose to a peak of $3.638 per coin, then fell to $0.036 by Oct. 1, 2022, based on data from Live Coin Watch.

The token no longer has tangible value at the time of publication, and its communication channels appear to have gone cold. A former user, who wished to remain anonymous, told Cointelegraph that the “[NFT] marketplace kind of dried out with not enough people using it and then very quickly everything went kind of offline including their website.”

The philanthropy that survived

In late 2021, the firm partnered with Austrian charity project Bbanga to help build a school for children in the Ssese Islands in Uganda. Bbanga commissioned German digital artist Mellowmann to release Uganda-inspired digital art pieces as NFTs, which were then to be sold via Orica’s marketplace. The sale surpassed the $6,500 goal needed to construct the school.

A former Orica staff member, who wished to remain anonymous, told Cointelegraph that “the Uganda school received full payment as this was overseen by Sani, Founder of the Bbanga Project, who was working with Orica at the time.” The project released a video this June showcasing that some of the school’s buildings had already been built, including a main hall and library.

On Dec. 21, 2021, charity group Hope for the Future also announced that it would be selling NFTs on Orica to fund its efforts. Hope for the Future is another Austrian-based nonprofit that helps victims of human trafficking reintegrate into society after they are rescued from captivity. The charity continues to operate today. Its efforts to help Ukrainian artists also materialized in the REFUGE campaign that ran in March 2022.

When prompted on the matter, the former Orica staff member said, “All artists were paid in full.” An amount close to $30,000 was raised in conjunction with Orica’s efforts to help Ukraine and was processed by crypto donations processor The Giving Block. In one of the last statements before going cold, Zey wrote: “We donated 10% of the amount we ever made. Our main product is tech that is built to give to people.”

And the project that didn’t …

Despite official claims as to why the project went down, blockchain data and user complaints suggest irregularities.

On May 11, 2022, the Polygon version of Orica was deployed as part of its migration from BNB Smart Chain. This version had a total supply of just 84 million tokens, 16 million less than the original Orica token on BNB Chain. The Polygon version of ORI was a “liquidity generator” token with built-in liquidity provider and swap functions. It had the ability to call contracts on the decentralized exchange QuickSwap, which is a fork of Uniswap v2 on Polygon.

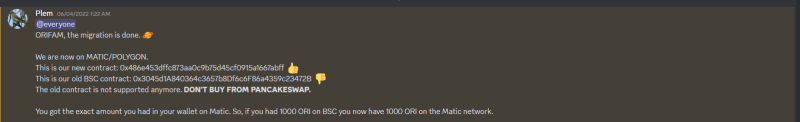

On June 4, 2022, an Orica Discord server admin who goes by the name “Plem” told users the migration was complete. According to Plem, users had received tokens on the new chain equal to the ones they held on the previous chain.

Some users complained that they had not received their tokens. In response, the admin told them to add the new token contract in MetaMask. If they did this and still did not see their tokens, they were asked to submit a support ticket.

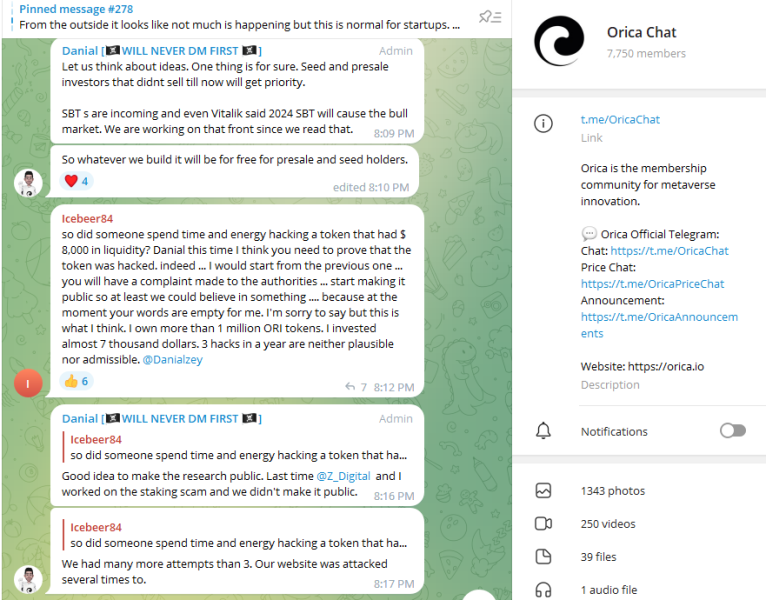

But the deployer on Polygon did not directly send tokens to users who held ORI on BNB. Instead, it transferred ownership to a separate account, which proceeded to sell nearly the entire supply of the coin through market-making operations. Zey stated that this second account was not operated by him. Instead, he claimed that a “hacker” stole his deployer key and transferred it. The new owner proceeded to call various liquidity provider and swap functions over the next two months on QuickSwap.

Zey did not report this attack until Aug. 11, 2022, exactly one month after it had occurred. A member of the team had reported 24 days after the “attack” that the migration had been completed. The same day, the new owner transferred an unusually large amount of tokens — 23,187,983 — to address 0x14dd44e1d3f9a173998c53d75622127ce921ccee. After this transaction, the new owner continued to post liquidity provider transactions for ORI tokens until the new owner stopped on Sept. 11, 2022. In a similar Aug. 11, 2022 Telegram message, Zey claimed that his laptop had been hacked and that tokens had been “moved out directly from the deployer.”

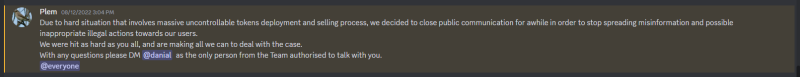

On Aug. 12, 2022, Plem announced that the project would be “closing communications” due to a “hard situation that involves massive uncontrollable tokens deployment and selling process.”

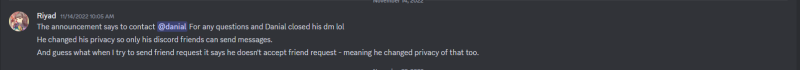

In the final message, users were told to send direct messages to Zey if they had questions, referring to the team’s blockchain operations lead. Subsequent messages to the group indicate that Zey has blocked all messages.

On Sept. 11, 2022, the new owner made a final transfer of approximately 150 Polygon (MATIC), worth $133.10 at the time, to address 0xfE3fB1d3C9FBF50b6af3A60b5D070dF68D87b99e. This account had previously received 3,463 MATIC ($3,082 at the time) from the new owner. At the time of publication, 9.9 million ORI ($4,341 at today’s price) remains in the account that was transferred ownership after deployment.

Co-founder’s new revelations

Speaking to Cointelegraph on Aug. 17, 2023, Zey denied the rug pull allegations, stating:

“I think the situation is complex and it is not wise to give out info that we might need to win some of the funds back. About the part with rug pull. We had a team of more than 15 people and we paid them until the end salaries plus we paid for the liquidity , Certik audit and some parts of the development.”

“Our tokens were locked,” said Zey. “On the blockchain it is also provable that we had several severe attacks on us. We are a charity project but still got hacked,” he stated while alleging that hacked funds were laundered through cryptocurrency mixer Tornado Cash, making it impossible to trace. “The few remaining people that worked without any salary like myself are still in this project working patiently behind the scenes but the comeback has to be strong so we can make up for the situation,” Zey claims.

Zey did not respond to a request for the hash ID of transactions linked to the alleged Orica hack.

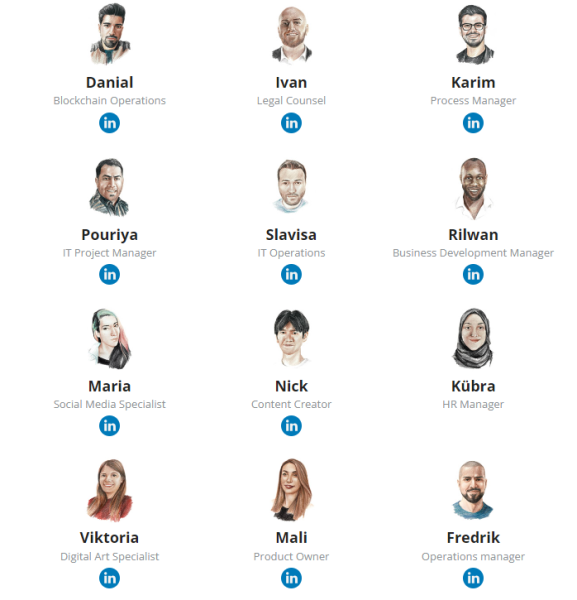

Out of 12 team members listed in the project’s ICO, five have deleted their LinkedIn profiles — Zey, legal counsel Ivan, process manager Karim, IT project manager Pouriya and business development manager Rilwan. The others, save for Zey, were either unreachable or had left Orica by the time of its breakdown.

A mixed legacy

As of today, most of what remains of Orica is in the brick and stone of a school in Uganda and the artists it has helped.

But also remaining are the tokenholders who never received a proper explanation as to why the project has ceased to exist. Despite breaking his silence, Zey never addressed the reasons for the hiatus, and many questions remain unanswered.

It’s not uncommon to see that investors and co-founders alike build rapport around a project as friends and exit as enemies during its collapse. But for Orica, there was at least a brief moment in which everything seemed to have worked well.

Cointelegraph editor Zhiyuan Sun contributed to this story.