In the latter half of June, the crypto market experienced a significant inflow and triggered a new wave of recovery. This upward trend was primarily led by the leading cryptocurrency Bitcoin as big asset management companies showed interest in spot Bitcoin ETF. However, the altcoins soon followed and presented favorable opportunities for those interested in long-entry positions. Moreover, DEFI tokens showed better performance in recent weeks and therefore provide better confirmation for a prolonged recovery.

Also Read: US House Chair Warns Gary Gensler After SEC Calls Spot Bitcoin ETF Filings “Inadequate”

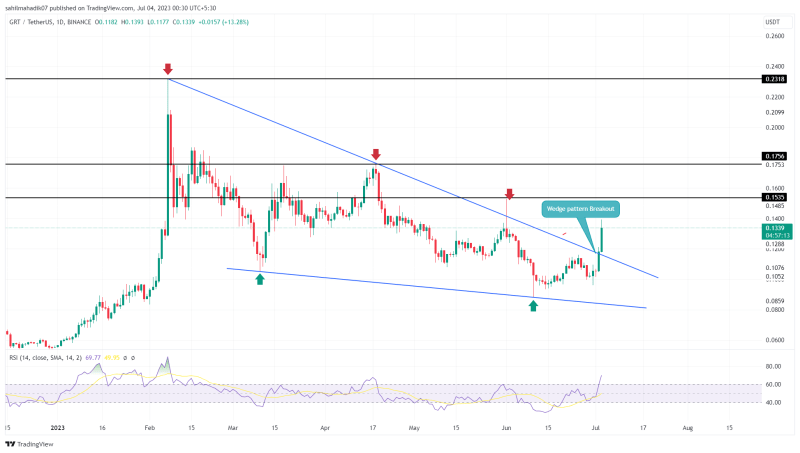

Graph(GRT) Price Analysis: Bullish Pattern Hints Recovery

Source: Tradingview

For nearly five months, the Graph token has been under a correction phase forming a falling wedge pattern. The upper trendline of this structure acted as a dynamic resistance and undermined the buyer’s attempt to kickstart a new recovery.

However, with the recent recovery sentiment in the market, the GRT price showed a massive breakout from the overhead trendline on July 2nd. With today’s intraday gain of 12.5%, the buyers obtained an excellent follow-up confirmation for further recovery.

With sustained buyers, the coin price could hit the potential target of $0.153, followed by $0.175.

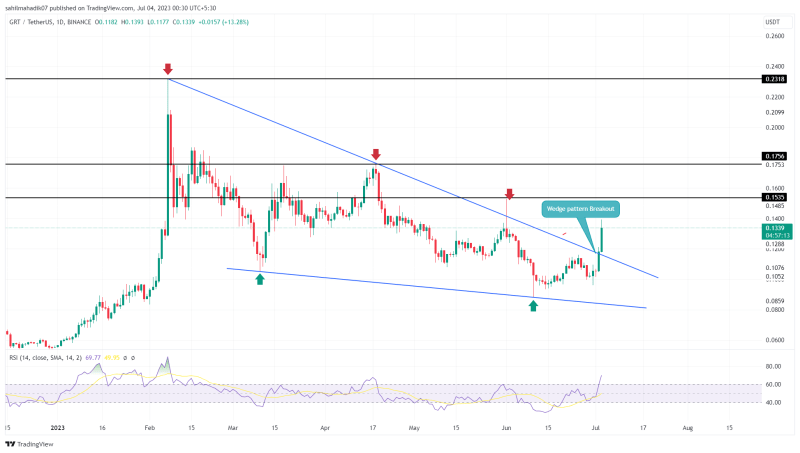

AAVE(AAVE) Price Analysis: Accumulation Brings Potential Rally

Source: Tradingview

In the weekly time frame chart, the AAVE price shows the formation of a descending triangle pattern. In theory, this pattern is a bearish continuation pattern but in rare cases, a breakout above the overhead trendline could trigger a significant upswing.

The momentum indicator rising reflects the buying pressure at the bottom is rising which increases the possibility of an overhead trendline breakout. Currently, the AAVE price trades at $74.17, and a breakout from the dynamic resistance could lead to altcoin to $96.5, followed by $124.5.

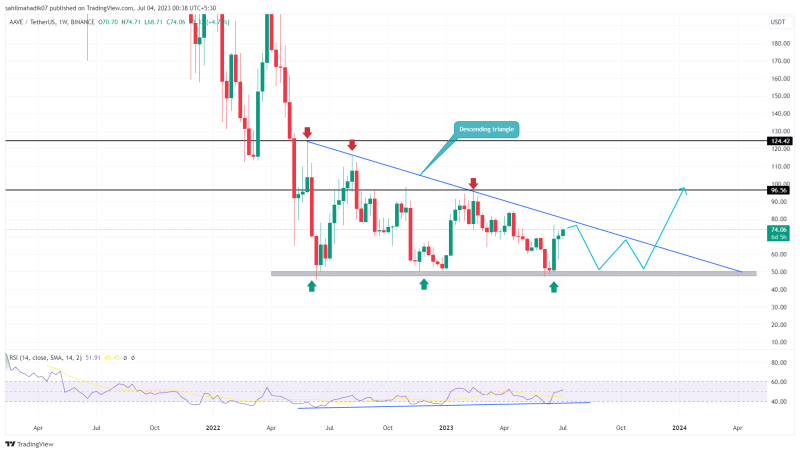

Maker(MKR) Price Analysis: Early Sign to Trend Reversal

Source: Tradingview

For over a year, the ongoing downtrend in Maker coin showed shallow lower lows or a nearly sideways trend. This lateral movement indicated the bearish momentum getting exhausted and the possibility of a bottom formation.

Amid the recent recovery in the market, the MKR price gave a massive breakout from the resistance trendline which restricted the upper trajectory from buyers since last year. From the breakout points near $820, the coin price has surged 21.8% to reach the $1000 mark.

Moreover, a long bullish candle today also breached the horizontal resistance at $973, indicating the coin price is poised for further recovery to $1173, followed by $1390.