Strong Market Participation and Higher Highs Support XRP’s Bullish Case

XRP has exhibited a Higher High and High Low structure since January 2023, indicating a strong market participant presence. This structure implies that buying opportunities can be found with each dip, as long as the previous swing low level of $0.4050 remains intact.

Consolidation Phase and Accumulation Zone

XRP has been consolidating between $0.4050 and $0.5600 since March 2023, showcasing a period of strong accumulation. Traders and investors have been accumulating XRP within this range, suggesting potential bullish momentum building up.

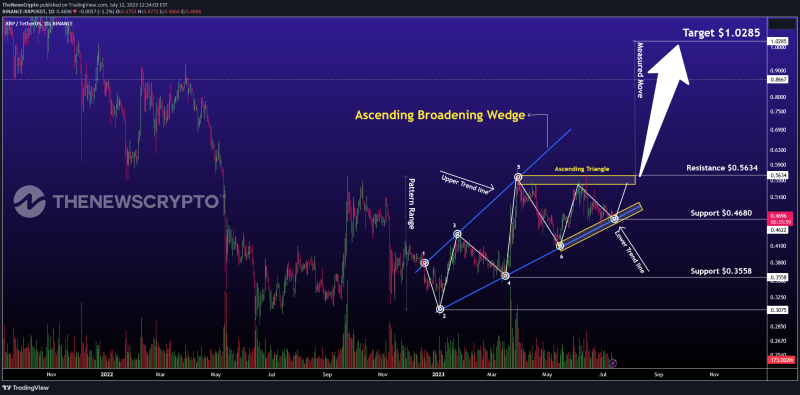

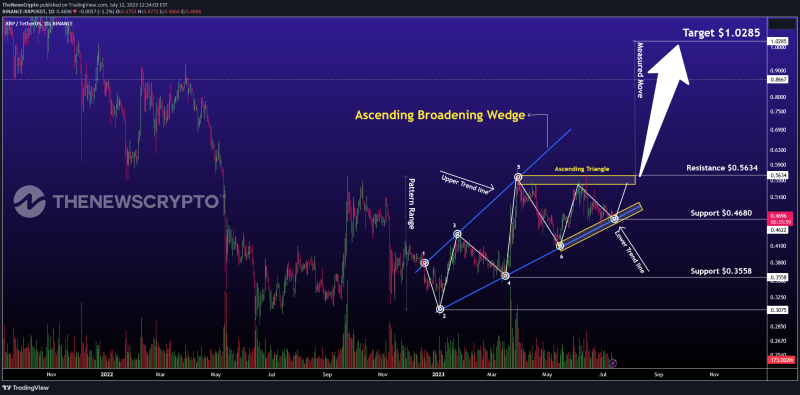

Broader Time Frame Analysis: Ascending Broadening Wedge Pattern

A broader time frame analysis reveals XRP’s Ascending Broadening Wedge Pattern, which has been in play for approximately six months. This pattern indicates a sustained bullish trend and demonstrates the cryptocurrency’s resilience on the upside.

Failed Breakout Attempt and Measured Move Target

In mid-April 2023, XRP attempted to breach the key resistance level at $0.5634 but experienced a subsequent pullback. By analysing the pattern structure, a Measured Move target has been identified, with a potential upside target of $1.0285 if XRP surpasses the $0.5634 level.

Risk Management and Caution

Implementing risk management strategies, such as setting a protective stop loss at $0.4680, is crucial to manage potential downside risks and protect trading positions.

Trade active Trade active Comment:

Trade active Comment:

Trade active