Solana Price Prediction: Amidst a volatile cryptocurrency landscape, Solana has emerged as a prominent player, rivaling Ethereum in Layer-1 scaling solutions. A recent analysis of SOL’s market trajectory reveals a dynamic pattern of growth and challenges, marking its position as a key cryptocurrency to watch.

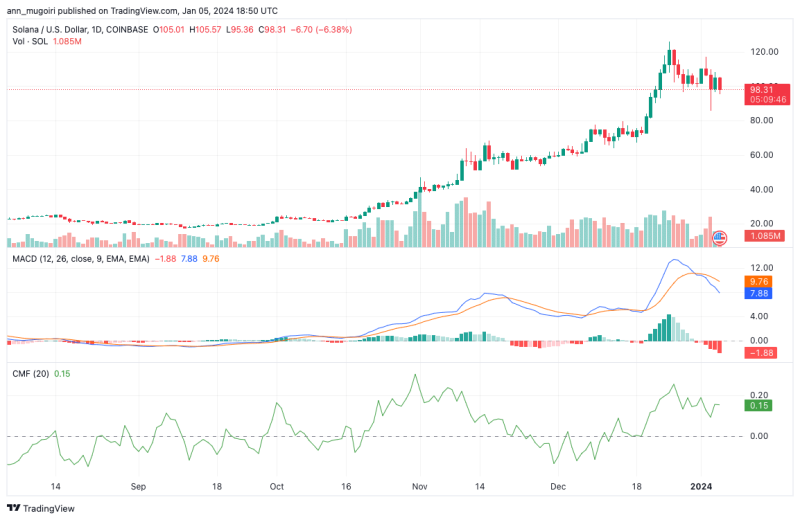

Solana’s price recently underwent a corrective phase in a fluctuating market, retracting from a short-term peak of $112 to a more constrained range between $95 and $100. Despite this consolidation, the currency’s journey has been impressive over the past few months. From a modest $17.3, SOL soared to a $126.2, marking an 615% increase. This surge has bolstered Solana’s market capitalization to approximately $41 billion and positioned it as the fifth-largest cryptocurrency.

Source: Tradingview

The latest trading session witnessed a 5.30% intraday drop in Solana’s value, registering a red candlestick pattern and bringing the price to around $97.85 at the time of writing. Despite this dip, the 24-hour trading volume shows a 5% increase, indicating sustained investor interest. However, SOL faces challenges in maintaining its value as bearish trends dominate the market.

As the bearish trend looms, SOL’s support level could potentially drop to $90. Currently, resistance levels for SOL are pegged at $100 and $115. If SOL breaks through the $115 resistance, it might aim for the $120 mark, a potential indicator of a more robust recovery. Investors and enthusiasts closely watch these market movements as bullish momentum could signify a turning point, fostering a positive outlook for Solana’s future performance.

Solana vs. Ethereum in Layer-1 Scaling

Solana’s co-founder Anatoly Yakovenko recently emphasized the platform’s commitment to Layer 1 scalability, challenging the prevalent view of adopting Layer 2 solutions. Yakovenko’s vision for Solana is to achieve a level of scalability that aligns with the maximum speed permitted by physical laws, a goal that he argues is critical in a world brimming with Layer 2 solutions. This stance sets Solana apart in the blockchain technology race, underscoring its potential to redefine the boundaries of cryptocurrency performance.

Will @solana ever require Layer 2 solutions? There’s nothing stopping developers from creating Layer 2s on Solana. However, Solana’s aim is to synchronize a global atomic state machine as fast as the laws of physics allow.

In this end state, any Layer 2, side chain, or…

— toly 🇺🇸 (@aeyakovenko) January 5, 2024

Solana Price Technical Analysis and Future Outlook

The 24-hour technical analysis of Solana paints a mixed picture. The Moving Average Convergence Divergence (MACD) is below the zero line, suggesting bearish momentum. Meanwhile, the Relative Strength Index (RSI) hovers at 53 in the neutral zone. However, there’s a silver lining, as both the 20-day Exponential Moving Average and 50-day EMA show positive trends.

SOL/USD daily price chart, Source: Tradingview

Additionally, the Chaikin Money Flow index(CMF) remains positive at 0.15, hinting at potential bullish sentiment in the near term. The current price of Solana trading above both the 50-Day Smooth Moving Average (SMA) and the 100-Day SMA indicates a bullish trend in the market in near-term.

Read also

- Solana Price Prediction 2024: Will SOL Price Cross $200?

- Solana Price Prediction: Here’s Why $SOL Correction May Turn To 26% Rally

- Solana Price Prediction: Should You Enter $SOL at $100 Dip?