A full rollout of the upgrade to fix network congestion may drive higher memecoin activity and demand for SOL.

Edited By: Ann Maria Shibu

- The project mentioned that the v1.17.31 update on the MainnetBeta would resolve the congestion issues.

- SOL’s price increased but on-chain activity slowed down.

After several days of waiting, Solana [SOL] has finally released an update to fix congestion on the network.

According to the update via Solana Status, validators on the MainnetBeta can now use the v1.17.31 upgrade which contains the necessary boost to solve the congestion challenges.

No more clogging

For some time, users found it difficult to finalize transactions on Solana. AMBCrypto’s investigation showed that the development was mainly due to the rising number of memecoins on the blockchain.

While the problem lingered, Solana started analyzing the proposed fixes on the 12th of April. At that time, Anza, a developer shop on the network, released a v1.18.1 Testnet upgrade to this effect.

An assessment of the network showed that Solana was fully operational and has now achieved 99.77% uptime in the last 90 days.

Meanwhile, it seemed like it was a good time for the problem to be addressed. This was because SOL, as well as memecoins on the network, have had their values increase in the last 24 hours.

At press time, SOL’s value increased by 4.68%. Bonk [BONK], the dog-themed memecoin on the network jumped while dogwigfhat [WIF] also followed.

With the update, the price of SOL might likely climb higher considering that demand for the token might increase. Despite the potential, it is important to evaluate the possibility on-chain.

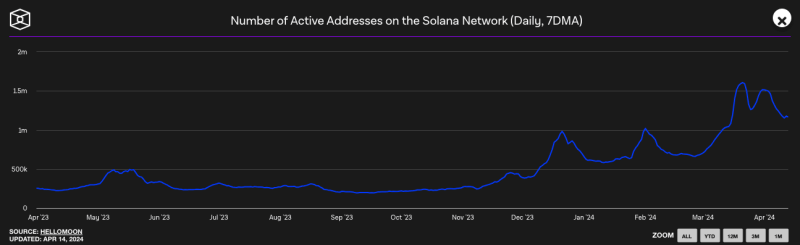

According to data from TheBlock, active addresses on Solana had decreased. As of this writing, active addresses were 1.17 million. This was a notable decrease compared to the first week of April.

Furthermore, Hello Moon, a Solana blockchain explorer showed that the number of assets moved on-chain remained low.

Are users about to demand more SOL?

At the same time, it might be too early to assume that the impact of the resolution would be instant. If activity on the network continues to decrease, then SOL might not surge as expected.

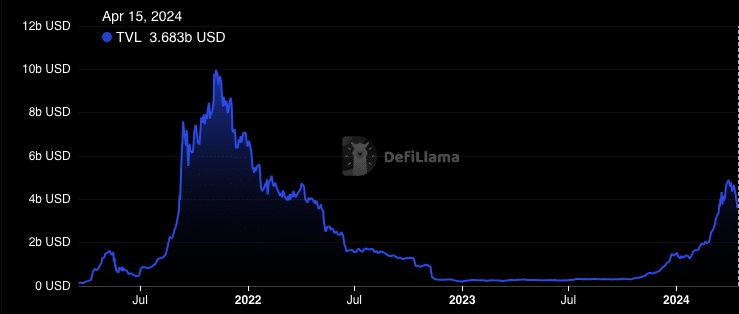

On the other hand, an influx of active users could improve the state of the token’s value. Another metric AMBCrypto looked at was its Total Value Locked (TVL).

At press time, Solana’s TVL was $3.68 billion. This value was a 22.83% decline in the last seven days. TVL is an indicator of a project’s health.

An increase in the metric means an increase in assets locked. However, a decrease suggests a fall in liquidity committed for yield.

Hence, the decrease suggested that market participants refrained from adding assets to protocols under the blockchain.

Realistic or not, here’s WIF’s market cap in SOL terms

However, the condition might change depending on the reaction of the market to the recent upgrade.

If users test and confirm that the network is up and running at full potential, the TVL might increase. If it is the other way around, users might keep starving Solana of liquidity.