After a tumultuous 2022 for Solana in which the crypto project lost its main backer, namely FTX, here come the first positive signs of recovery with several metrics showing growth, especially in the NFT and liquid staking sectors.

Successful implementations in the technology stack and important new partnerships are driving the resurgence of Solana and its crypto SOL, which many are still betting on, including institutional investors.

Will the famous “Ethereum killer” blockchain network be able to return to its heyday with its decentralized ecosystem?

We see it together in this article.

Solana’s progress in recent months: excellent numbers in liquid staking

Solana has been posting excellent numbers since the beginning of the year after a catastrophic 2022, with the NFT and liquid staking sectors driving the crypto project’s progress.

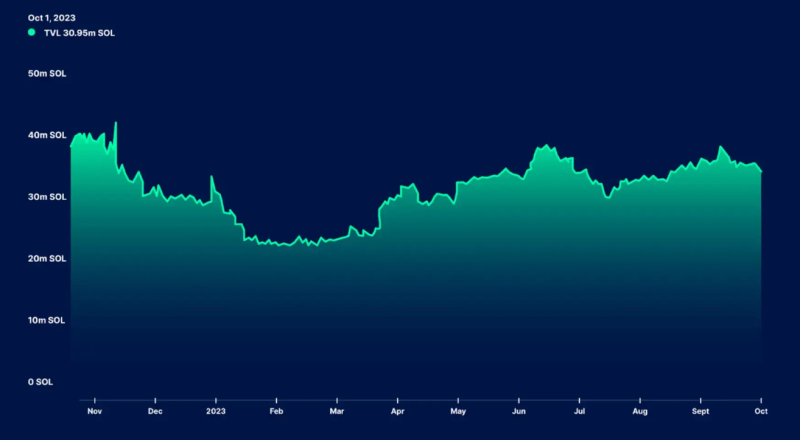

Starting with the basics, we can see how during 2023 Solana’s TVL increased from 25.12 million SOL to the current 30.95 million.

Even in USD, the metric marks an increase of more than 50%, giving investors hope that the worst of the bear market is now behind us.

Indeed, the emotional and image damage caused by the collapse of the FTX exchange in November 2022 (the main backer for technology developments) and all the recent problems related to network outages seem to have been overcome.

The crypto project team continues to innovate with major improvements in the technology stack achieving major milestones in the NFT market (which we will elaborate on in the next section) and achieving 100% chain uptime since the beginning of the year.

This is an excellent achievement for Solana considering that it has been repeatedly attacked publicly, as often in the past it has been necessary to perform a synchronized reboot of the network through the coordinated intervention of the validator team.

In addition, the two partnerships signed with Shopify and Visa in the past two months have been well received by the community, with both companies developing their services on top of the decentralized infrastructure.

On the liquid staking front, we can see that in the last month all LSD protocols on Solana have seen strong growth with TVL increasing in double digit percentages.

Jito for example has seen a 62.33% increase in value locked within the application over the past 30 days, while the top-of-the-line protocol Marinade Finance has grown by 20.65%.

Over the course of the year, more than 2.4 million SOLs have been added to Jito, sending metrics on this platform soaring.

Investors are seizing the profit opportunities in a niche sector such as liquid staking on Solana, where only 3-4% of SOLs are actually being staked while on Ethereum we can observe a percentage around 40% for the same context.

The return offered by these crypto platforms is twice as high as those offered by Lido, RocketPool and Stakewise on Ethereum, where however we can count a higher level of security.

Currently, the LSD market on Solana is worth about $258 million, and forecasts assume further upside on the horizon.

Crypto: Solana improves some waits in its technology stack and reduces minting costs for NFTs by 2,000 times

As mentioned earlier, Solana’s developers have moved over the past year to introduce key upgrades by improving its technology stack.

The positive effects have been seen in terms of both the development of the crypto ecosystem as a whole and the NFT market in particular.

One of the most interesting updates to mention in this regard is Firedancer, which by promoting significant optimizations should make Solana’s validation client much more effective than the foundation’s current client.

To date, only 3% of the crypto market is on the Solana Virtual Machine (SVM) while the remaining 97% works primarily with the Ethereum Virtual Machine (EVM).

At each Firedancer and hardware/bandwidth side improvements could contribute to SVM adoption.

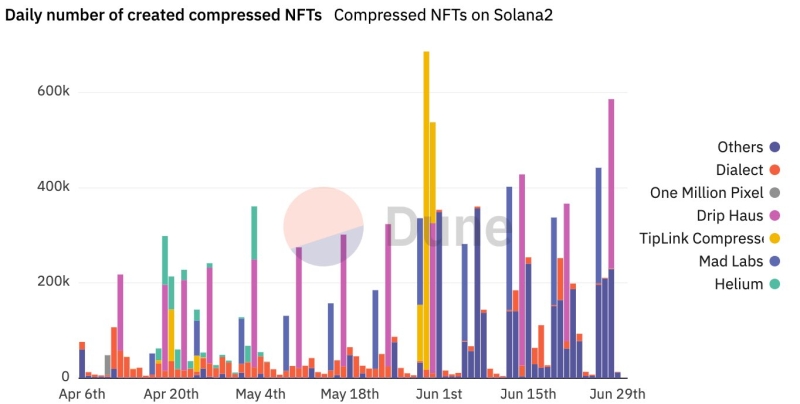

Turning instead to the NFT topic, it is worth noting the innovation introduced in April this year with the “State Compression” solution that greatly reduced storage costs by keeping data off the original chain.

By leaving only essential data on the Solana chain and using the Merkle Trees structure, the developers arrived at a compressed version of non-fungible tokens, namely cNFTs, which are highly optimized on the data storage side.

In June 2023, Tensor launched its compressed NFT market by taking advantage of this technology implementation and capturing most of the market share of the collectible cryptographic asset market on Solana.

The main advantage of “State Compression” is essentially about reducing the cost of mining per c-NFT by being the storage itself (done off-chain) better challenging.

Consider that without the compression technology, the minting cost for 1 million NFTs would have been $253,000 whereas now it requires only $113.

This is a reduction of more than 2,000 times the cost of minting, which is a key competitive advantage within the blockchain landscape.

Solana by doing so has also become cheaper than Polygon on this front, as to create 1 million NFTs, Sandeep Nailwal’s network requires payment of $32.8 thousand in gas fees.

Ethereum in comparison still remains the most expensive network with the highest fee costs in the market, but also with the most thriving ecosystem and on which the most volumes are spinning.

Solana is still far from reaching the same goals as the world’s second-largest decentralized network after Bitcoin, but with this new update the distances have shortened considerably as have improved growth prospects for the coming years.