- SOL/BTC’s prolonged triangular consolidation has ended with a bullish breakout.

- Solana-based decentralized exchanges register record weekly trading volume that’s bigger than the combined activity in Ethereum, Base and BSC.

Unmute

01:01Bitcoin Breaks $64K While Gold Soars

00:56ETH/BTC Ratio Slid to Lowest Since April 2021

00:57Is Bitcoin Losing Its Bullish Momentum?

It’s said that the best trades occur when the tape, or the direction of the price trend, aligns perfectly with the fundamentals. The solana-bitcoin (SOL/BTC) ratio appears to be one of those rare cases, showcasing a solid bullish price pattern supported by equally impressive activity on the Solana blockchain.

Price Breakout

The SOL/BTC ratio rose over 1% last week, moving out of a narrowing price range, referred to as triangular consolidation in technical analysis.

The breakout indicates that the bulls are finally willing to lead the price action, having been in a stalemate with the bears for eight months. In other words, a sustained uptrend looks likely.

The Moving average convergence/divergence (MACD) histogram, a indicator used to identify trend changes and strength, has crossed above zero, indicating a renewed bullish shift in momentum.

Fundamentals validate breakout

Whether Solana will ultimately replace Ethereum as the top smart contract blockchain remains a hot topic of debate. However, one thing is clear: Solana has established itself as the go-to-place for retail investors to trade memecoins, as evidenced by the surge in trading volumes which supports the bullish outlook for SOL.

Solana-based decentralized exchanges (DEX) have registered cumulative trading volume of $41.6 billion in the seven days to Nov, 17, more than double the preceding week and the highest on record, according to data source Artemis.

The Solana blockchain alone did more volume than Ethereum, Base and BSC’s cumulative DEX activity of $37.9 billion, of which Ethereum accounted for $14.3 billion while the rest did over $11 billion each.

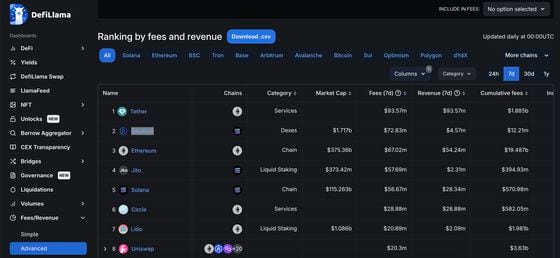

Furthermore, Solana continues to compete the rivals in terms of free revenue despite known for being relatively cheaper than Ethereum. For instance, the Solana-based decentralized exchange Raydium has generated $72.83 million in fees in seven days – that’s 8% more than Ethereum’s $67 million, according to DefiLlama. BTC, meanwhile, has generated a fee revenue of around $15 million in seven days.

Edited by Parikshit Mishra.