In the midst of its ongoing correction phase, the SHIB price has begun to obtain notable buying interest around the $0.000007 threshold. The daily chart reveals a shift from the previous descending trajectory to a more lateral movement, symbolizing a depletion of the bearish drive. As the overall sentiment in the cryptocurrency market tilts toward recovery, the meme coin traders might leverage this newfound base at $0.000007 as a catalyst for a revitalized ascent.

Also Read: Shiba Inu (SHIB) Burn Rate Jumps 276% Amid Crucial Ecosystem Update

Can SHIB Price Reclaim $0.000008 Mark?

- The SHIB price witnessed increased buying pressure near the $0.0000007 mark.

- The formation of a double bottom pattern hints potential upswing

- The intraday trading volume of the Shiba Inu coin is $83 Million, showing a 10% gain.

Source- Tradingview

With an intraday gain of 1.66%, the Shiba Inu price revealed a bullish morning star candle configuration right at the $0.000007 juncture. This second reversal in price within a month at the aforementioned support led to the inception of a bullish technical pattern – the Double Bottom.

In theory, this pattern showcases the accumulation of buyers at these lower levels, serving as a signal for a forthcoming bullish phase. Given the momentum of this technical formation, the coin’s trajectory is expected to intersect and possibly breach the immediate resistance set at $0.0000076.

A convincing surge past this pivotal resistance, validated by the close of the daily candle above it, could furnish buyers with an optimal foundation to propel the price even higher. The post-breakout rally would elevate the coin’s valuation by an additional 15%, aiming for the $0.0000087 milestone.

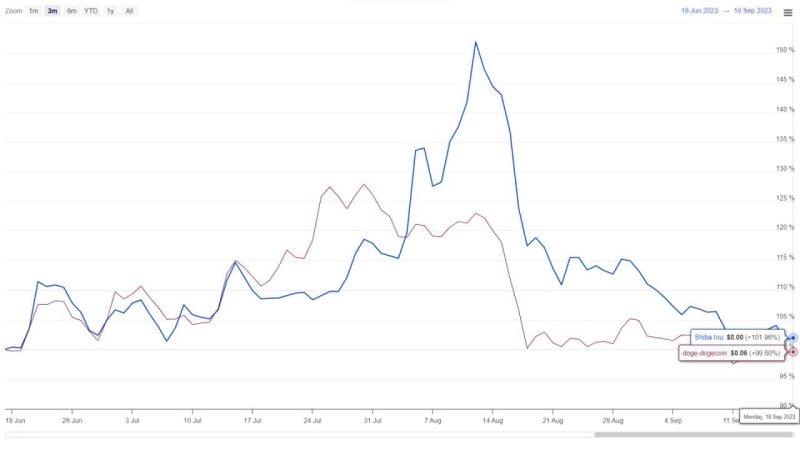

SHIB vs DOGE Performance

Source: Coingape| Dogecoin Vs Shiba Inu Price

An overview of SHIB price performance over the trailing three months unveils a consistent bearish undertone since the latter part of August. The persistent establishment of lower lows and highs accentuates the seller’s dominance in this asset.

Meanwhile, in a contrasting scenario, the Dogecoin price seems to navigate a more sideways course, signaling its inherent resilience amidst the overarching bearish climate.

- Bollinger Bands: The lower boundary’s uptick on the Bollinger Bands suggests the buyers could obtain additional support from this indicator

- Relative Strength Index: The daily RSI slope above the 40% mark signifies the increasing bullish momentum.