Polkadot’s latest report on the ecosystem’s performance in Q2 provided key insights on sectors like staking, development activity, and DeFi.

- Polkadot jumped from third to second place in terms of total developer count in Q2.

- The DeFi landscape witnessed a descent after peaking in mid-April.

Multichain protocol Polkadot [DOT] released a report highlighting the state of the ecosystem in the second quarter of 2023. Touching down on key areas like development activity, staking, and the decentralized finance (DeFi) economy, the report revealed some fascinating insights.

Read Polkadot’s [DOT] Price Prediction 2023-24

Development activity on the rise

Over the years, Polkadot has emerged as one of crypto’s largest developer ecosystems. Q2 2023 further solidified its dominance in development activity.

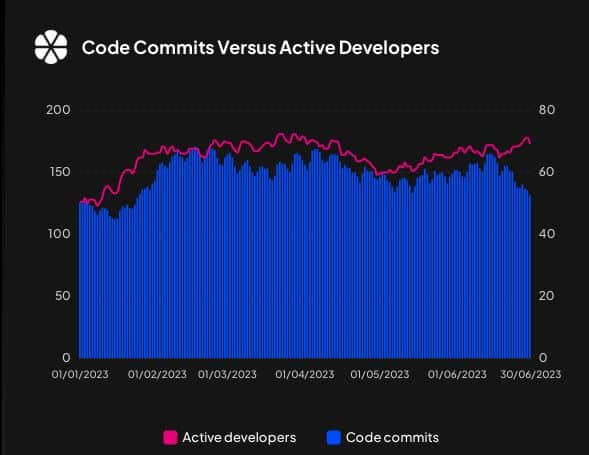

The core developer count, which is basically the number of distinct GitHub users that made at least one commit to the repositories, reached an all-time high of 181 on 22 March. Though there was a sharp decline in the latter part of April, the metric rebounded to stay consistent until the end of the quarter.

Polkadot jumped from third to second place in terms of total developer count as of 1 June, with nearly 1,923 builders operating on the network. About 33.93% of these were full-time developers.

What’s hot in staking?

On the staking front, Polkadot benefitted from some key enhancements introduced in the last quarter. The fast unstake mechanism, which allowed unstaking of DOT before the usual 28-day waiting period, was widely embraced.

Since its implementation, an average of six unique users and 2.38K DOT have been unbonded on a daily basis.

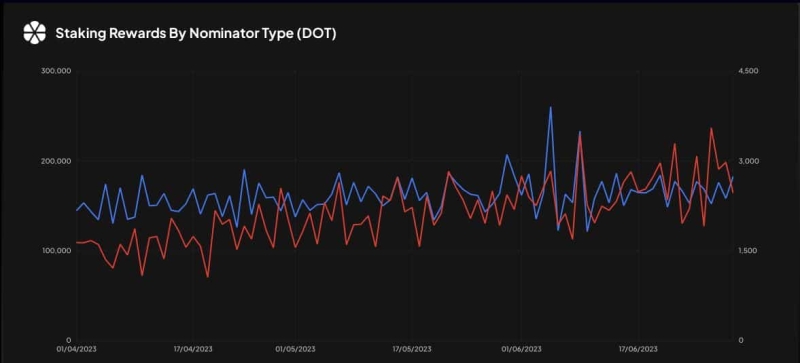

Moreover, daily rewards from nomination pools rose steadily, from the range of 1.06K-2.55K DOT in April to that of 1.69K-3.56K DOT in June. On the other hand, rewards earned by individual nominators stayed relatively flat.

DeFi activity on a roller coaster ride

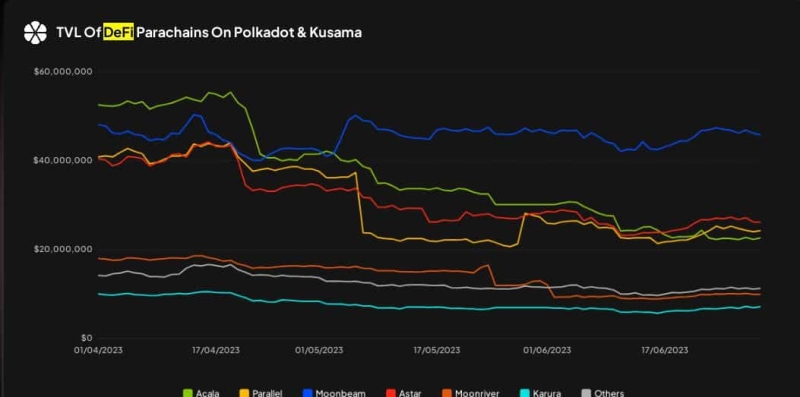

In Q2, the Polkadot ecosystem’s DeFi landscape weathered the ebbs and flows. The total value locked (TVL) on all parachains peaked at $236 million in mid-April. However, the downfall began soon afterward and Q2 ended with a TVL of $146 million, a massive 38% drop from the quarterly highs.

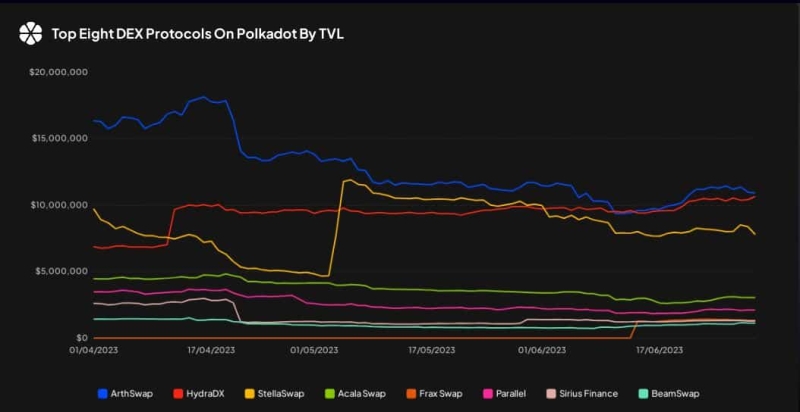

Similarly, the ecosystem’s decentralized exchanges (DEXes) saw a drop in liquidity after reaching peaks in April. Arthswap retained its numero uno position as the largest DEX in terms of TVL almost throughout Q2.

However, towards the tail end of the quarter, HydraDX managed to narrow the lead considerably, trailing by just $264.29k.

Realistic or not, here’s DOT’s market cap in BTC’s terms

The Q2 report underscored that it was not sunshine and roses for the ecosystem. However, the spike in development activity was indicative of faith in its long-term prospects and adoption.

Native token DOT was ranked as the eleventh-largest crypto by market cap, with a valuation of more than $5.4 billion at the time of writing, per CoinMarketCap. The coin grappled with negative sentiment owing to the broader market rout, having dropped 10.72% of its value over the last week.