On the back of a Bitcoin rejection at $29.6k, the DOT sellers forced prices to fall as deep as $4.62 on 15 August.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Polkadot saw its market structure flipped bearish earlier this month.

- A price move to $4.6 was brewing, but any further losses would indicate a drop as far south as $3.9 was on the table.

Polkadot [DOT] saw the bears pull off a convincing move downward after the market structure break in early August. Social metrics and development activity were on the rise but this did nothing to dissuade the sellers.

Is your portfolio green? Check the Polkadot Profit Calculator

The price chart showed that there was a downtrend in progress, and a move toward $4.6 was highly likely. Whether the bulls can defend that level of support or not remains to be seen. The latter development could see DOT drop below the $4 mark.

The attempts to defend $5 over the past two weeks left the buyers exhausted

On 2 August, DOT fell below a recent higher low at $5.1. Marked in orange, this denoted a market structure break in favor of the bears. Thereafter, the price bounced between the $4.95 and $5.06 levels until 15 August.

About 36 hours before press time saw the bears seize the initiative. On the back of a Bitcoin [BTC] rejection at $29.6k, the DOT sellers forced prices to fall as deep as $4.62 on 15 August.

The Directional Movement Index showed a strong bearish trend was close, and the RSI also signaled strong bearish momentum. In contrast, the CMF logged a notable influx of capital into the DOT market.

Fibonacci retracement levels (yellow) were plotted based on the mid-June rally. The 78.6% level at $4.59 was one that bulls must defend. It has confluence with the bullish D1 order block from June.

A daily trading session close below $4.59 would signal bears remained dominant. It would likely spur a move downward to $3.92.

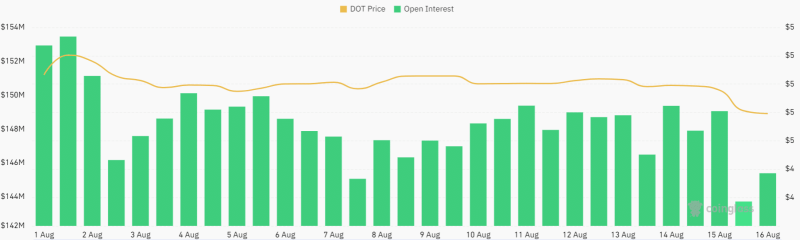

The Open Interest and funding rates supported the bearish idea

The Open Interest saw some gains from 8 August to 11 August. During this time DOT hovered around the $5 support level. After 15 August, the OI saw a sharp plunge as prices dropped. This suggested bearish sentiment in the market, but did not point toward a rise in short positions in the market.

Realistic or not, here’s DOT’s market cap in BTC’s terms

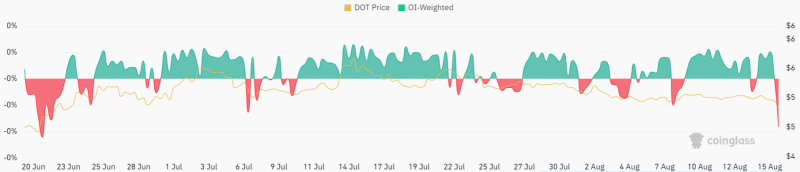

The funding rate dropped deep into the negative territory. It had a reading of -0.0182% at the time of writing, according to Coinglass data. Together, the OI and funding rate showed bears had an advantage.

The funding rate flipping negative suggested the majority of the market was looking to sell DOT. This was not good news for long-term bulls who would want to see the $4.6 level defended. A Bitcoin recovery was one thing that could help DOT buyers.