DOT has patterned itself for a major rally in the coming days.

Edited By: Ann Maria Shibu

- DOT faces a critical juncture and is challenged by a significant resistance zone at $4.463.

- Emerging evidence suggests that DOT is primed for a rebound.

Despite recent struggles, including a month-over-month decline of 7.86%, analysis of current data and technical patterns indicate strong momentum that could soon propel Polkadot [DOT].

Technical analysis indicates a potential major upswing for DOT

On the technical front, Polkadot is set for a significant run-up into higher territories. DOT was trading within an ascending triangle pattern at press time, a configuration often seen as a precursor to a substantial rally.

Although it has recently rebounded off the resistance zone of this pattern and is trending downward, this setback is expected to persist until it reaches the next support zone within the pattern at $4.277.

At this level, sufficient buying power is anticipated to potentially breach the resistance.

Should this breach occur, the next price target for DOT is set at $5.1. Conversely, a movement in the opposite direction could see the price revert to the bottom of the ascending triangle pattern.

Retail interest in DOT heightens

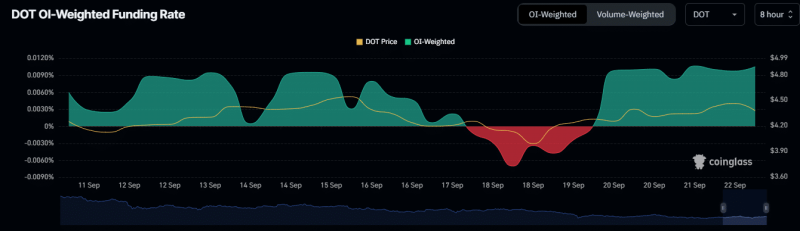

Retailers are showing a keen interest in DOT moving higher. According to Coinglass, the OI-weighted sentiment is significantly positive, indicating strong buying interest.

OI-weighted sentiment assesses market sentiment by factoring in both the directional sentiment (bullish or bearish) and the open interest of options or futures contracts, particularly futures in the case of DOT.

This method places greater emphasis on sentiments associated with larger financial stakes, which, for DOT, are predominantly bullish.

Moreover, there has been a substantial liquidation of short positions, with traders who bet against DOT suffering heavy losses totaling $64.88 thousand as the price has not moved in their favor.

DOT is in a good spot to rally

The market’s strength for DOT remains robust, as indicated by the Relative Strength Index (RSI), which is on an upward trajectory forming higher highs—signaling a strong bullish presence ready to propel DOT’s price.

Read Polkadot’s [DOT] Price Prediction 2024–2025

Despite this positive outlook, DOT might experience a short-term dip. It could align with the $4.277 support level identified by technical analysis.

From this juncture, DOT is expected to initiate a vigorous rally, potentially reaching the significant target of $5.1 in upcoming trading sessions.