Two years ago, Flament allegedly had no knowledge of NEAR, but now claims that it possesses one of the “best-funded treasuries” in the industry.

Flament Asserts Near Foundation Enforces Strict Governance

As per a recent statement, Flament’s role within NEAR will persist as she takes on the responsibilities of a council member and acts as an advisor to the incoming CEO, Donovan.

“Two years ago, I had never heard of NEAR. Upon doing a bit of research and after several conversations it became clear that NEAR had a tremendous potential – fantastic tech, a diverse and vibrant community and a world of open possibilities, and so I joined.”

Flament provides details about the partnerships NEAR has forged over the past two years, which include notable names such as Google, Amazon, and KPMG.

She also claims that user growth rose from 50,000 to 3 million monthly active accounts. Furthermore, she claims that 66% of the top Decentralized Apps (Dapps) are built on NEAR:

“2 out of 3 of the top Dapps on Dappradar are built on NEAR.”

DefiLlama data reveals that the NEAR protocol holds the 36th position among blockchains in terms of Total Value Locked (TVL).

NEAR has a TVL of $36.59 million. Ethereum secures the top spot with $21.18 billion in TVL.

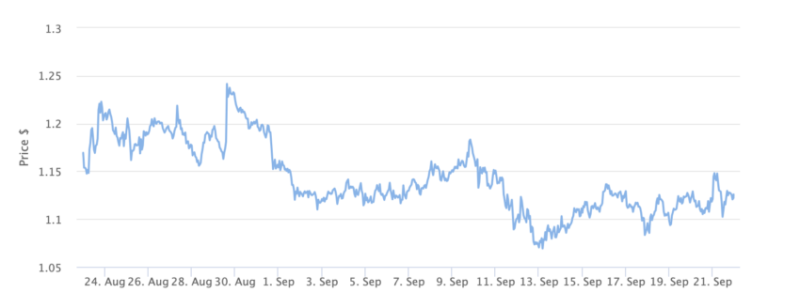

At the time of publication, NEAR’s token price is $1.13.

NEAR Price Chart 1 Month. Source: BeInCrypto

Flament explains that she took on the role because she believed in creating a better internet through an Open Web. Furthermore, she strived to help tackle some of the “world’s biggest challenges” by leveraging decentralized technology.

She emphasizes that one significant highlight was the creation of NEAR Horizon. This is an on-chain platform that provides valuable support to project founders to help them improve their projects.

Flament claims that NEAR has a safe treasury despite many internal and external crises going on in the crypto industry. She asserts that the current treasury includes $350 million with 330 million NEAR tokens.

Crypto Industry Sees Recent Resignation Trend

Lately, the crypto industry has witnessed a series of resignations.

Most recently, three senior executives at Binance.US resigned. On September 14, the head of legal and chief risk officer both submitted their resignations.

This occurred just one day after CEO Brian Shrodder announced his resignation.

The news coincides with Binance.US’s ongoing legal issues involving the United States Securities and Exchange Commission (SEC). The company reportedly reduced its workforce by a third, which was roughly 100 job cuts.

A recent report disclosed that Peter Marton, the deputy superintendent of virtual currency at the New York State Department of Financial Services will resign at the end of this month.