Introduction

I have been waiting for an OG coin alt season for over a year now. A lot of the top 10 or top 20 coins from 2015, 2017 and 2017 massively over performed compared to bitcoin and Ethereum and have had to go through an even longer cooling off period than those cryptos did. Monero has dropped to the 20s in coinmarketcap.com’s rankings and some of the coins I favor as trades and ideologically are a lot lower.

I got a bit excited around February/march of 2022 but did not get the follow through that I was hoping for. Now that I have see a flip of the monthly parabolic SAR I am a lot more optimistic that a high probability move to the upside is beginning in Monero and my choice alts. Since they are lower down in market cap one cannot build a position as easily as one could in a top 10 or 20 coin. There is a lot of wicks and slippage when entering a position too enthusiastically or carelessly. I cannot just market into a margin position without creating a wick that immediately puts me under water and messes up my margin level. But if I am right the gains will be worth it.

Main Analysis

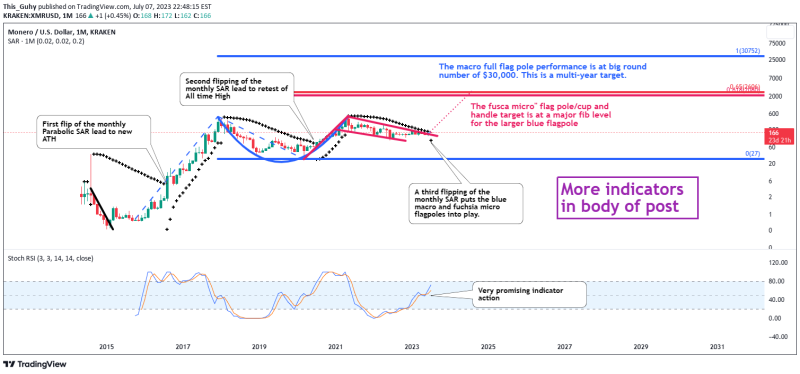

The Parabolic SAR is quite a nice indicator on the higher time frames. It was literally named Stop And Reverse and was designed to find places where price can take a U turn. If you are expecting a multi-month or multi-year to happen based on whatever (analysis, fundamenals, etc) a flip of the SAR helps clear “technical resistance” much in the same way clearing the 200SMA in a bear market is a sign that a bull market is brewing.

Another technical resistance we have cleared is the resistance line of the flag. We popped through quite nicely and have been going sideways for about 10 days after the initial move began. While there is a chance that we can retest the flag’s previous resistance as support I think it is more likely that price pumps. A lot of biases of a lot of traders should have flipped to bullish with the SAR. The bull season is still in the early stages and there is still a lot of doubt but generally the bulls will be winning.

Other Charts

The monthly chart for both other times the Parabolic SAR flipped bullish look amazing when viewed with Heiken Ashi candles. Massive 50-70 percent pull backs don’t seem to matter anymore when viewed on the HA chart. The idea that I can get into this trade the first week it is happening is pretty exciting.

The Parabolic SAR is usually used with some momentum indicator and the inventor of the Parabolic SAR liked to use another of his creations, the ADX. Here is a simplified version. Looks promising.

The chart below shows the long term SMA situation. Price is winding up for its next move between the 200 and 100 SMAs. I think it will be to the upside in a big way.

My channels chart set up has the gaussian and Keltner channel (1 and 2 ATR multipliers). Price is struggling at the guassian midline and I think we will see an upside resolution. The chart also shows that the keltner midline (the 20 EMA is a good place to buy pull backs on this uptrend if it is similar to the 2016 uptrend.

Lots of people like to talk about price action but don’t spend enough time talking about volume action. One of the best indicators for volume is the On Balance Volume and with some moving averages it is really easy to tell when the long term buying and selling pressure has flipped. I am very optimistic that XMR’s OBV SMAs will flip bullish.

Since volume can vary by exchange here is Binance as well

Where is the money going to come from?

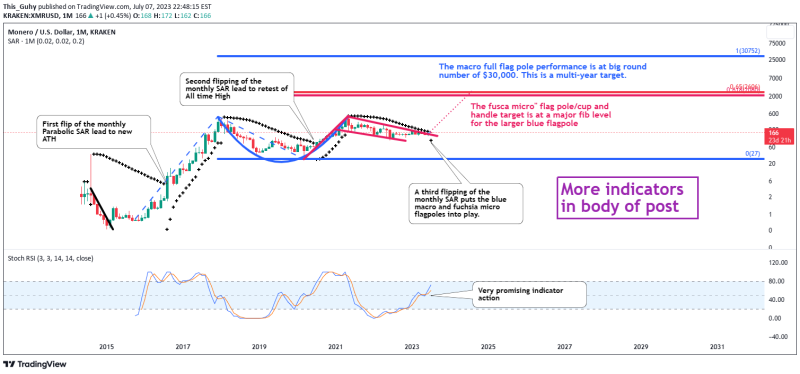

Money has to come from somewhere to pump XMR and the other OG coins I favor. I think it is going to be rotated out from the ETH ecosystem. Many times a W pattern will have price pump to a double top or even all time highs and then price returns to the rise between the valleys. The chart below shows that both XMR and LTC had price return to the rise between the valley.

Also, my linked ideas will have my bearish post on NDX. I think the equity markets will be howling here shortly as price retraces deeper.

My plan

I am looking to add to my positions with a simple pull back strategy. When both the Log MACD and Stoch are below zero know we have just had a pull back and that pull back will have generated some support and resistance lines. I will look to buy when price is again above that resistance line and catch some momentum. This will help me not buy and have the price continue to fall which is always nice. I will not be buying the bottoms though.

I do not like the idea of buying things and having it be the same price six months to a year later. Much nicer to buy the pull back and watch price climb out of the hole and not return.

I have this planned for a lot of the OG coins, many of which are now in obscurity. Zcash and Dash are in the 70s and 90s. Very low market cap. XPR, BCH and others are still rather big but not as exciting but they are going to be bought on pull backs just the same.

XMR also topped over 200 days before total 2 did on this last uptrend. I have to be prepared to rotate out of XMR and into other coins if XMR reaches its major targets.