Since the last halving, Litecoin’s hashrate has remained stable, and its difficulty reached an all-time high on 2 August.

- Litecoin’s miner fees have been declining for weeks.

- LTC’s weekly chart was painted red, but metrics suggested a trend reversal.

Litecoin [LTC] mining industry has been able to maintain its growth trajectory after the blockchain’s latest halving on 2 August, 2023. Not only was the blockchain’s hashrate stable, but its mining difficulty recently touched an all-time high, reflecting stable growth in the ecosystem.

However, since halving LTC’s performance on the price front has not been up to par. Considering LTC’s bearish price action and the decline in mining reward, will the sector be able to maintain its growth?

A closer look at Litecoin’s mining sector

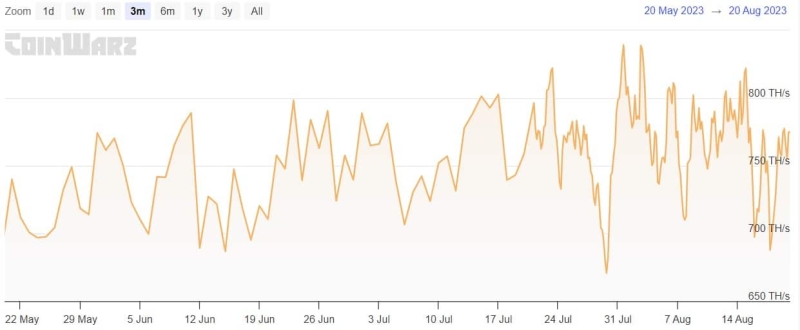

Since the blockchain’s third halving, Litecoin’s hashrate has remained stable. Rather, if past weeks are to be considered, the sector was showing consistent growth. At press time, Litecoin’s hashrate was 772.99 TH/s.

Additionally, as hashrate increased, mining difficulty also went up, even touching an ATH on 5 August 2023. These metrics clearly reflect the growing popularity of Litecoin mining.

It was interesting to note that a possible reason behind this surge could be Dogecoin [DOGE].

Shan Belew, a popular crypto influencer, mentioned in a recent tweet that high hashrate might be the result of Dogecoin being merged-mined with Litecoin.

Litecoin's mining network remains steady after the litecoin halving.

Even though price dumped half after the sell the news event, the miners kept mining. This is likely the result of dogecoin being merged mined with Litecoin. Dogecoin made the switch over to rely on Litecoin… pic.twitter.com/QxMHbocyOG

— master (@MASTERBTCLTC) August 18, 2023

However, the growth rate might halt soon as a few of the metrics revealed the possibility of miners exiting the network. For instance, Glassnode’s chart pointed out that LTC’s mining fees have been declining for months.

LTC’s performance on the price front was also concerning. According to CoinMarketCap, LTC was down by more than 22% over the last week. At press time, it was trading at $64.40 with a market capitalization of over $4.7 billion.

The latest halving had already reduced miners’ rewards to half. That, combined with a drop in miners’ fees and a substantially low coin price, can motivate miners to exit the network in order to look for more profitable mining options.

Can Litecoin’s price be the savior?

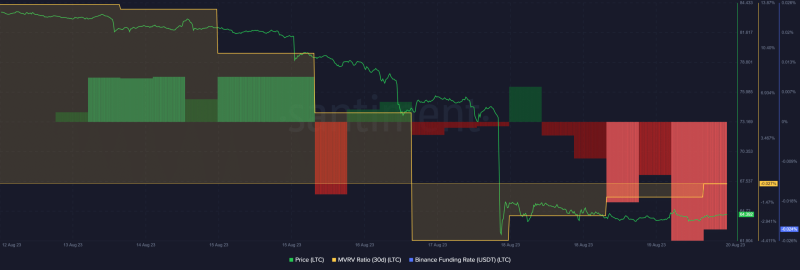

LTC’s price can play a crucial role in sustaining the growth of its mining ecosystem, as it can help miners increase their profit margins. Thankfully, a few of the metrics looked positive for LTC. For example, after a sharp drop, Litecoin’s MVRV Ratio recovered slightly.

Additionally, its Binance funding rate was red, meaning the derivatives buyers were not purchasing the token at its current price. This increased the chances of a trend reversal.

Therefore, whether LTC’s price chooses to follow a northbound route in the days to come, will be interesting to watch.