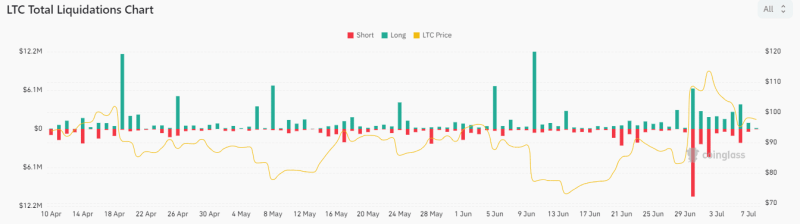

We examined the state of liquidations recently and discovered that there has been a fair share of liquidations on both sides. However, Litecoin pivoted on 3 July and on the same day the number of long liquidations was higher than short liquidations.

- Recapping Litecoin’s performance days after spotting pivot signs.

- Long liquidations surge but not enough to have an impact on price.

A few days ago, we observed Litecoin at a critical price range. It was previously on a bull run and had just entered the overbought territory. As such it was only a matter of time until the bulls ran out of momentum.

How many are 1,10,100 Litecoins worth today

Fast forward to the present and the Litecoin bulls did end up going on a break, paving the way for a bearish retracement. To put things into perspective, Litecoin peaked at $114.49 on Monday, followed by a 17% drop to a weekly low of $94.23. A slight recovery in the last 24 hours allowed it to rally to its $97.37 press time price.

Long liquidations surge, fueling more downside

Something interesting happened during the rally. Traders in the derivatives segment gained more confidence. This confidence encouraged more traders to execute long positions. Long liquidations tend to contribute to more sell pressure and this might have contributed to more downside for Litecoin. But was this really the case for LTC’s recent price action?

We examined the state of liquidations recently and discovered that there has been a fair share of liquidations on both sides. However, Litecoin pivoted on 3 July and on the same day the number of long liquidations was higher than short liquidations. The same trend has continued for the last few days.

Litecoin traders should note that that the level of liquidations is likely too low to have a significant impact on price. As such, it appears that onchain activity was fueled by spot market supply and demand forces.

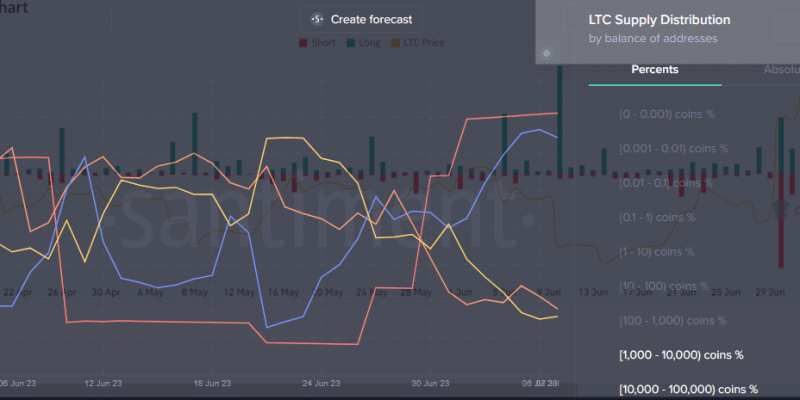

Speaking of supply and demand, it was worth noting that the recent sell side correction may already be slowing down. LTC’s supply distribution may offer insights as to why. Addresses holding between 100,000 and 1 million LTC (denoted in yellow) have the largest share of Litecoin in circulating supply. Interestingly the same whale category has been trimming its balances in the last few days.

The same whale category was slowing down its pace of outflows. This allowed Litecoin to take a break from the sell pressure in the last 2 days. Perhaps more interesting is the point at which this happened because it could point to the next critical support.

Is your portfolio green? Check out the Litecoin Profit Calculator

Litecoin previously demonstrated support and resistance within the $95 to $98 price range. It is currently in this range, which means the next few days will determine if the bulls will regain control or not. Remember that August is rapidly approaching, hence the dawn of the next halving is almost here. As such, LTC holders have an incentive to hodl.