The price of Bitcoin and Ethereum surged nearly 4% in just a 15-minute window, sparking bullish predictions for the month of October.

More than $70 million in crypto shorts were suddenly liquidated after a surprise jump in the price of Bitcoin (BTC), Ether (ETH) and other cryptocurrencies on Oct. 1.

According to data from TradingView, the sudden pump saw Bitcoin surge 3% in just 15 minutes from $27,100 to $28,053 before settling down just below the $28,000 mark at the time of publication.

Happy Uptober to those who celebrate.

Remember 2021? pic.twitter.com/qgHy1ThGOf

— The Wolf Of All Streets (@scottmelker) October 2, 2023

Similarly, the price of Ethereum’s native currency, Ether, also surged, gaining as much as 4.7% in a brief spike to $1,755 before leveling out to $1,727 at the time of publication.

The sudden movement has left most in the community scratching their heads. Many commentators said the move aligned with the arrival of “Uptober.”

Welcome to Uptober.

Welcome to Q4, which is leading towards a great quarter, potentially fueled by ETF approvals and the pre-halving rally.

Potentially #Bitcoin to $40,000 is reasonable.

— Michaël van de Poppe (@CryptoMichNL) October 1, 2023

Other community members suggested that “someone knows something” that others don’t.

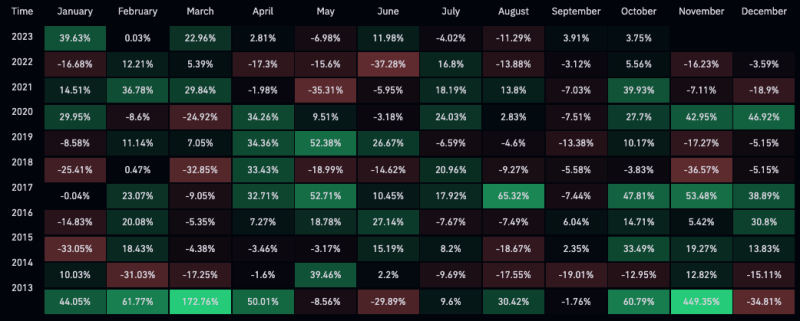

Uptober is crypto parlance for October typically being a bullish month for the price action of Bitcoin and other cryptocurrencies. According to data from CoinGlass, October has only produced negative monthly returns twice since 2013.

One of the events that the crypto market is looking forward to with optimism is the potential approval of a spot Bitcoin exchange-traded fund by the United States Securities and Exchange Commission. However, most analysts are tipping January 2024 as the most likely date for such an announcement.

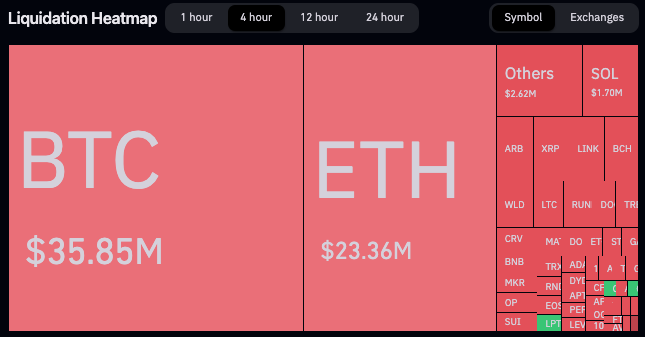

Meanwhile, while those holding spot and long positions may have celebrated the first significant price action in over a month, short sellers have had the opposite luck.

The rapid uptick saw $70 million in short positions liquidated in just two hours.

According to data from CoinGlass, nearly $36 million worth of BTC shorts and $23 million worth of ETH shorts were “rekt” by the sudden price move.