Bitcoin’s price action has been sluggish for a few days, but the trend might change soon.

Edited By: Jibin Mathew George

- Bitcoin’s price dropped by 2% in the last 7 days

- Market indicators hinted at a few slow-moving days ahead

Bitcoin [BTC] began June on a sluggish note as the coin’s price action remained bearish on the charts. However, the slow-moving price action might not be a bearish thing, as this just might be a prelude for a massive rally in the coming days.

Bitcoin to turn bullish?

Bitcoin’s price action has remained sluggish for quite some time now, which might have made several investors skeptical. In fact, according to CoinMarketCap, BTC has lost 2% of its value in the last seven days. At the time of writing, BTC was trading at $67,735.81 with a market capitalization of over $1.33 trillion.

However, things might change soon. Mags, a popular crypto analyst, recently shared a tweet highlighting an interesting development. According to him, BTC’s price, after breaking out above the last monthly resistance back in March, has now turned the level into a support. For the past few months, the price has been going sideways above the previous ATH.

During a market uptrend, it’s normal for the price to move sideways before a big move. In 2023, from March to September, the price stayed flat for 7 months before it broke out and surged by 178% on the charts.

According to the analyst,

“So, even though it might seem boring, this kind of sideways movement usually comes before a massive move. If we see a similar 178% surge on the current range breakout, we are looking at $188,00.”

Is there any evidence here?

Since the aforementioned analysis predicted BTC to touch $188K, AMBCrypto then analyzed the king of cryptos’ metrics to better understand whether it is all set to test its ATH in the coming days. We found that BTC’s net deposit on exchanges was high at press time, compared to the last seven-day average.

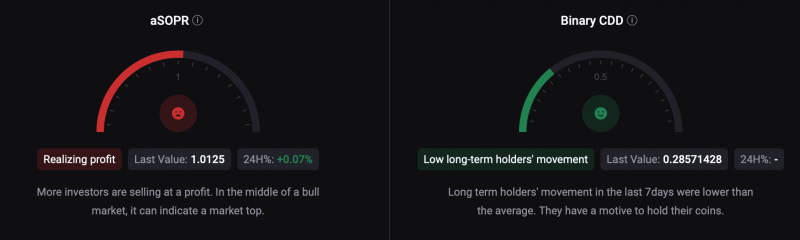

This suggested that selling pressure on the coin has been high. Additionally, the aSORP was also red, meaning that more investors have been selling at a profit. In the middle of a bull market, it can indicate a market top.

Nonetheless, Bitcoin’s binary CDD revealed that long-term holders’ movements in the last 7 days were lower than average. They have a motive to hold their coins.

AMBCrypto then analyzed BTC’s daily chart to better understand whether it could test its ATH anytime soon.

As per our analysis, the MACD flashed a bearish crossover. Its Relative Strength Index (RSI) also moved sideways, hinting at a few more slow-moving days.

However, BTC continued to trade above its support at $66.9k, hinting at a possible price hike in the coming days.