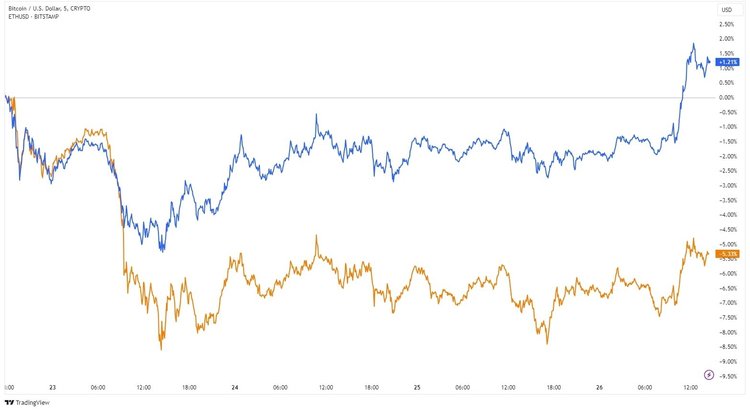

A substantial volume of Bitcoin and Ethereum options reached their expiration on January 26. Let’s delve into how this might impact the prices of these underlying assets. Cryptocurrency options are derivative contracts enabling traders to buy or sell an asset at a predetermined price on a specific expiry date. Opting not to execute the transaction is entirely at the discretion of the option holder, making options a more flexible instrument compared to futures, which mandate closing out a position irrespective of profit or loss. The notional value of the expiring contracts is significant, with 93,600 BTC contracts totaling $3.4 billion and 931,610 ETH contracts amounting to $2.07 billion. The question now is whether this expiration could trigger heightened market volatility and influence the prices of the top two cryptocurrencies by capitalization. At the moment of writing, the options market is leaning towards bears, evident in the put/call options ratio for BTC holding at 0.51. This indicates that twice as many calls or long contracts have been sold compared to puts or short contracts. While open interest remains high at the $50k strike price, with 22,719 call contracts, the short-term trend is on the decline. Put sellers may find themselves in profit, particularly as their open interest is highest at the $40k strike price. Switching to Ethereum options, the put/call ratio is 0.31, signaling that call sellers significantly outnumber put sellers. This suggests a bearish sentiment among derivatives traders regarding ETH. Anticipating the market’s response after the expiration of a substantial number of contracts is challenging, especially when considering potential events affecting the news background. Nevertheless, traders should closely monitor the situation to prevent increased volatility from triggering unwanted stop-loss orders or leading to erroneous trading decisions. BTCUSD and ETHUSD chart. Credit: TradingView This week, the Bitcoin price dipped below $39k due to active sales by Grayscale. The primary cryptocurrency has partially recovered after the Bitcoin ETF approval story, trading around $40 thousand. Ethereum exhibited similar dynamics, momentarily dropping to $2,180. In conclusion, the aftermath of the contract expiration remains uncertain, emphasizing the importance for traders to stay vigilant amidst potential market fluctuations. The opinions expressed in this article are those of the authors.