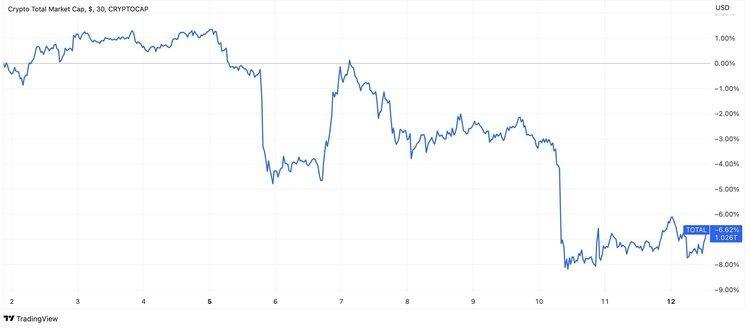

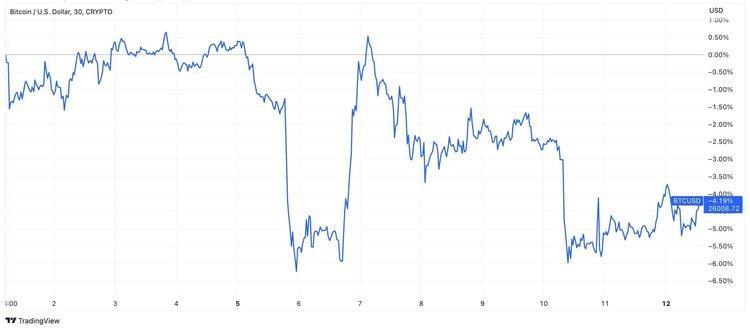

The Securities and Exchange Commission has filed lawsuits against Coinbase and Binance, resulting in significant implications for the crypto market. This recent development has led to a period of stress and uncertainty within the industry. “First time?”, you can ask with James Franco’s grin. Not the first one, of course, but this case may become a game changer. Let us delve into why this is the case and what other outcomes we might anticipate. To begin, it is worthwhile to examine the chart of crypto market cap. The picture below proves that the allegations are affecting the market, and every crypto investor and trader felt this punch. During this selloff, the native token of Binance, Coinbase stocks, and numerous others were adversely affected. Additionally, given the significant influence of Bitcoin in the crypto market, it is evident that its performance, as depicted by the BTC/USD chart, was also influenced. The SEC has leveled 13 separate charges against Binance, the world’s largest crypto exchange, and its CEO, Changpeng Zhao. Among other things, the regulator alleged that it is operating an unregistered securities exchange, misusing customer funds, and misrepresenting trading controls. The next day, it was Coinbase’s time to take the heat. The biggest crypto exchange in the US faced similar accusations of selling unregistered securities. SEC has long held negative sentiments towards cryptocurrencies, and it’s not surprising. Cryptocurrencies have always been in a gray zone where traditional economic and financial rules do not entirely apply, and new rules have yet to be established. The SEC strives to domesticate crypto, with SEC Chair Gary Gensler likening cryptocurrencies to characters from the Wild West. In other words, the regulator believes that, as a minimum, a number of cryptocurrencies can be classified as securities, meaning that traditional requirements should be applied to the exchanges facilitating their trade. If the SEC wins these cases, it may set a precedent capable of altering the crypto markets. However, it is essential to note that the jurisdiction of the SEC is limited to the United States. Moreover, Binance and Coinbase have decided to fight for their rights. It leads us to possible trials between exchanges and the SEC, and such processes might last for years. That means we can live in an even more uncertain than usual crypto world until the issues are resolved. Each piece of news regarding these trials will impact the market, potentially causing fluctuations in coin prices. Conversely, these events might also pave the way for the creation of agreements and laws that benefit the crypto industry. By formulating regulations that account for the specificities of cryptocurrencies, the industry could attain greater clarity and reliability, potentially fostering long-term growth. The opinions expressed in this article are those of the authors.