The SFC’s chief executive, Julia Leung, said the regulator will entertain proposals that “boost efficiency and customer experience.” Earlier this year, many investors viewed US investment manager BlackRock’s application to launch a Bitcoin (BTC) exchange-traded fund as a sign the market was ready for a spot ETF.

Hong Kong ETF Will Need Risk Review

Leung said the alleged fraud at the Hong Kong Exchange JPEX Leung highlights the need for a “comprehensive regulatory framework” to ensure that risks for a crypto ETF are properly mitigated. JPEX and its management allegedly misappropriated $178 million in customer funds.

“We’re happy to give it a try as long as new risks are addressed. Our approach is consistent regardless of the asset,” she said.

Leung’s comments come as the SFC fine-tunes its crypto regime after introducing its first set of rules in June. It is also working on new regulations to govern stablecoins and the tokenization of real-world assets.

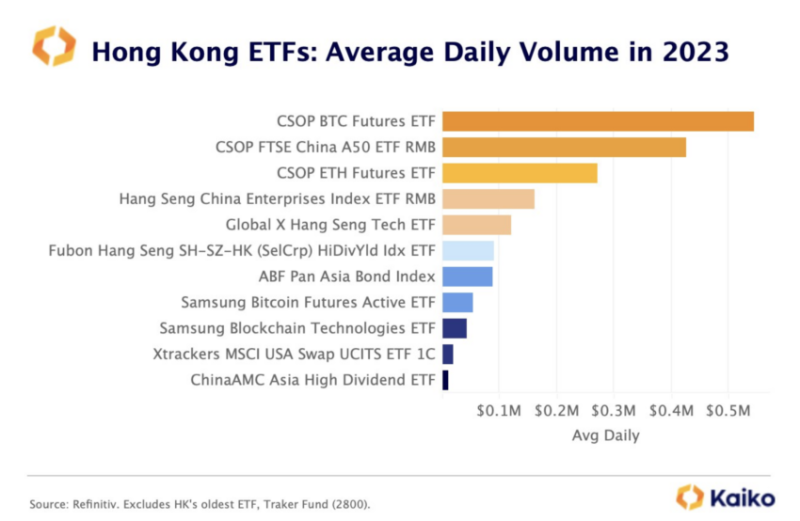

Average daily volume Hong Kong ETFs | Source: Dessislava Ianeva (Kaiko Research)

The Hong Kong Monetary Authority (HKMA) is also developing guidelines to help banks hold tokenized assets. Its efforts may help the SFC develop rules on how to secure crypto assets held in exchange-traded funds.

US Needs Rules on Customer Assets

The US Securities and Exchange Commission (SEC) has delayed approving Bitcoin ETFs for fears the underlying market could be manipulated. The agency does not want customers to lose assets if the price of Bitcoin goes down.

Several companies, including BlackRock, Bitwise Asset Management, Fidelity Investments, and Franklin Templeton, have applied to launch Bitcoin ETFs. Grayscale Investments is pursuing the conversion of its closed-ended Bitcoin trust into a spot ETF.

The SEC said spot funds could be prone to manipulation and be potentially harmful to US investors. To mitigate this risk, several investment managers amended their applications to include market surveillance agreements with exchanges.

The approval of a crypto ETF may also need clearer laws that govern the safekeeping of customer assets. A 2023 proposal by the SEC currently requires a qualified third-party custodian to hold assets on behalf of customers. The SEC has not provided a clear qualification path nor provided a list of qualified companies.

For example, Coinbase Custody safeguards digital assets on behalf of BlackRock. It uses multiparty computation that prevents the easy theft of crypto, but there is no explicit law standardizing this arrangement.

Best crypto exchanges in Europe | November 2023

Paybis No fees for 1st swap →

YouHodler Free cloud miner →

Wirex 1000 WXT for KYC →

INX No fees for 30 days →

OKX Up to $10,000 →