Bitcoin’s recent price stability near $30,000 reflects sell-taker dominance. Declining miner revenue and rising whale interest shape its trajectory too.

- Bitcoin’s price stabilized around $29,000-$30,000 amidst market volatility

- Seller-taker volume and declining miner revenue surfaced as potential reasons for price suppression

Amidst the backdrop of significant price fluctuations and heightened volatility, Bitcoin [BTC] has ultimately found a point of stability, hovering within the range of $30,000 to $29,000. This recent period of relative calm has prompted speculation among various experts regarding the potential for this subdued volatility to extend over a more prolonged duration.

Read Bitcoin’s Price Prediction 2023-2024

Hike in selling pressure

One noteworthy observation comes from analyst Maartunn at CryptoQuant, who highlighted a significant disparity between Sell Taker Volume and buyer activity. This ongoing discrepancy in trading volumes could lead to sustained downward pressure on the price, thereby preventing a decisive breakthrough above the $30,000-mark.

For context, sell-taker volumes are the ratio of sell volume divided by the buy volume of takers in perpetual swap markets. It reflects the pre-eminence of selling pressure in the market.

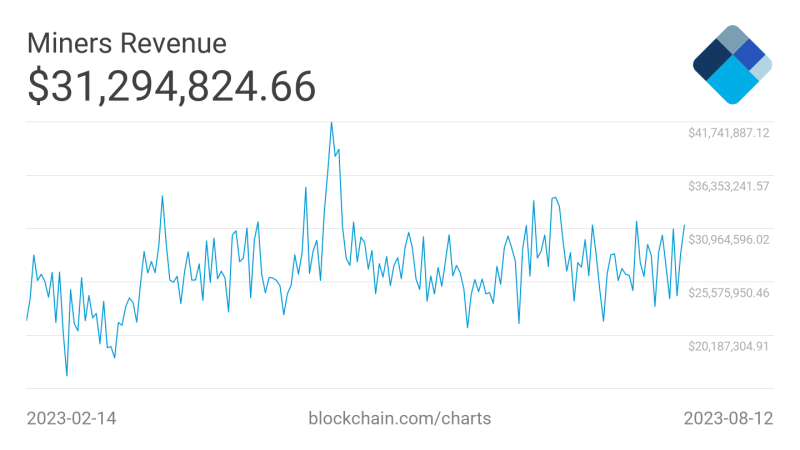

The impact of this sustained selling pressure is further underscored by the context of declining miner revenue. In fact, recent data revealed a reduction in miner earnings, with figures dropping from $41 million to $31 million over the last few months. This decline in revenue can potentially incentivize miners to offload their Bitcoin holdings to remain profitable.

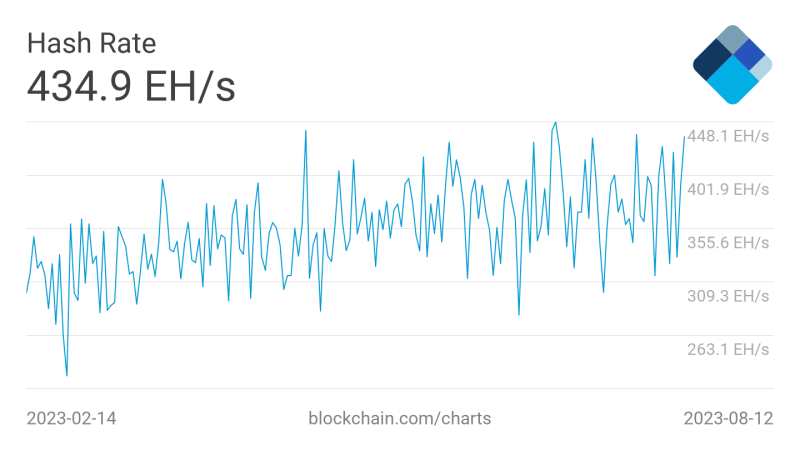

Interestingly, despite the challenges posed by reduced miner revenue, other metrics suggested an underlying resilience within the network. Both hashrate and network growth have shown signs of improvement during this period, reflecting the strength of the Bitcoin ecosystem.

Whales show interest

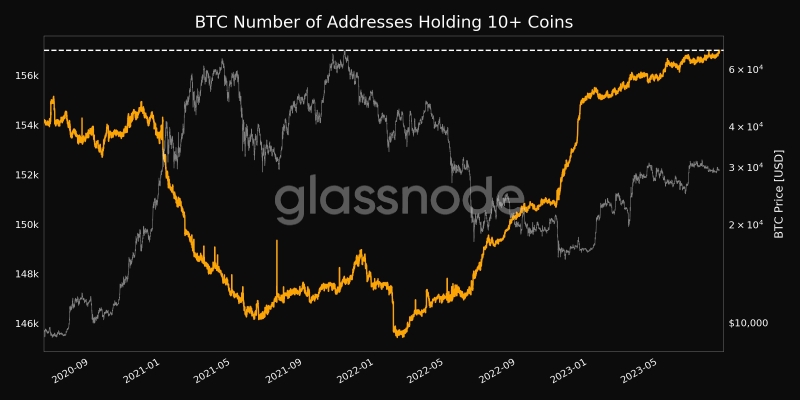

Contrary to these factors, whale behavior indicated a positive future for Bitcoin. For example, Glassnode’s data indicated that the number of addresses holding 10 or more BTC coins recently hit a three-year peak at 157,012.

This uptick in whale activity suggests a growing appetite for Bitcoin accumulation among larger investors.

A parallel development involved HODLing behavior observed from BTC addresses. Notably, figures for the amount of HODLed or lost coins achieved a five-year high at press time.

This revealed a propensity among current investors to retain their holdings over an extended period. This behavior also reflected a sense of confidence and long-term conviction in Bitcoin, despite a lack of positive price movement on the charts.

Is your portfolio green? Check out the Bitcoin Profit Calculator

At press time, Bitcoin’s price stood at $29,300. Furthermore, the velocity of transactions had fallen, implying a reduction in the frequency of BTC transfers.