The Fibonacci extension levels proved reliable in recent days as Cardano prices saw a reaction from them.

- The technical higher timeframe bias was strongly bullish.

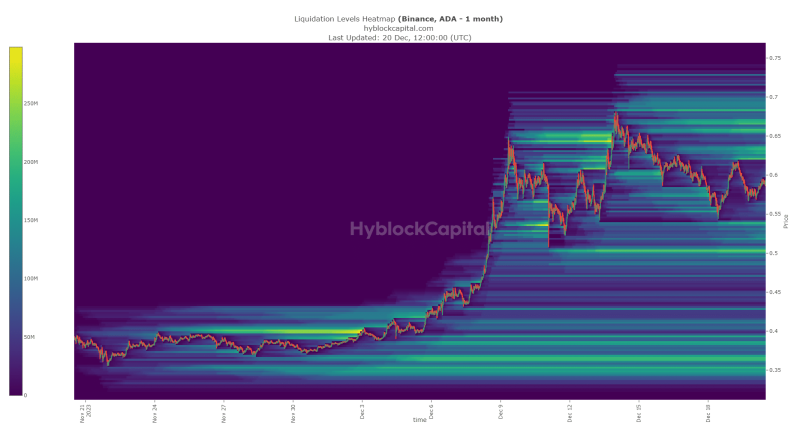

- The liquidation heatmaps highlighted two critical support levels where the bulls could drive another rally from.

Cardano [ADA] reached a high of $0.68 on the 14th of December before falling lower. Its higher timeframe market structure remained bullish, but a key level of support at $0.6 was not defended in the past few days.

Earlier this week, AMBCrypto reported that Cardano witnessed a high development activity. The total number of development activity contributors was also high. This would encourage long-term investors that ADA is a good asset to hold.

The 23.6% extension and beyond have been important

On the 16th of November, ADA reached the 23.6% extension level before facing rejection. It eventually breached this level on the 5th of December, and has noted rapid gains since then.

On the way higher, the 123.6% and 223.6% extension levels have also been respected.

The 123.6% level was retested as support on the 11th of December, and a daily trading session did not close beneath it. Similarly, the 223.6% level rebuffed buyers on the 14th of December.

The $0.595 level was significant back in August 2022, marking a monthly high. The price has reacted from this level on the 4-hour and lower timeframes, marking it as a level to watch.

A drop below $0.512 would be necessary to flip the one-day market structure bearishly. Meanwhile, the OBV has dipped in the past few days but could trend higher.

The RSI fell to 61 to show that bullish momentum was still strong but had slightly weakened compared to a few days ago.

The liquidity pools to the north could be swept

AMBCrypto analyzed the liquidation levels heatmap and found that the $0.54 level was a strong candidate for a bullish reversal. However, whether prices would go further south from here was unclear.

The $0.62-$0.64 area also represented a large pocket of estimated liquidation levels.

Read Cardano’s [ADA] Price Prediction 2023-24

Hence, it was possible that ADA prices could take a turn upward to $0.64 before moving lower. Further higher, the $0.65-$0.67 zone could also be tested.

Since the bulls were unable to defend the technically important $0.595 level, it was likely that a dip to $0.54 could materialize soon.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.