With the price of Bitcoin (BTC) hovering around $35,000, and with many believing the worst of the bear market is now over, FTX is seeking to capitalize on the upswing.

FTX Wants to Sell Trust Assets to Mitigate Risk

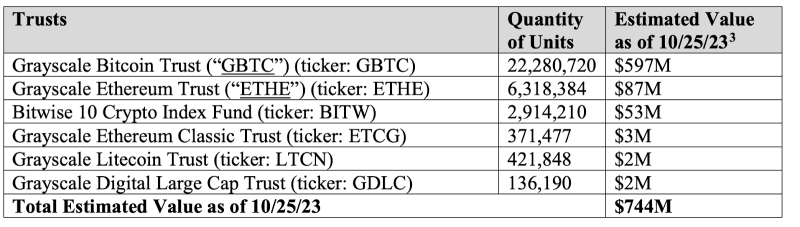

The screenshot below shows the estimated valuation of the assets:

Estimated value of FTX’s Trust assets. Source: Court documents

The court filing explains:

“The Debtors’ (FTX Trading Ltd.) judgment is that proactively mitigating the risk of price swings will best protect the value of the Trust Assets, thereby maximizing the return to creditors and promoting an equitable distribution of funds in the Debtors’ plan of reorganization.

“It also is prudent for the Debtors to obtain authorization to conduct sales of the Trust Assets at this time in order to preserve flexibility in advance of plan confirmation and time transactions so as to minimize any potential negative effects on market prices.”

Lastly, John T. Dorsey, the US Bankruptcy Judge, approved the motion, allowing FTX to sell the Trust assets. The sale will take place through a court-approved investment advisor.

Stephen J. Kurz, the Global Head of Asset Management at Galaxy Digital, declared in support of the Motion:

“I believe that any sales of the Trust Assets will be appropriately limited by the Sale Procedures, which are designed to maximize the value of the Trust Assets.

“Accordingly, I believe that any sales or transfers of the Trust Assets in accordance with the Sale Procedures will maximize the value of the Debtors’ estates.”

In August, BeInCrypto reported that FTX had hired the digital asset management company Galaxy Digital as an advisor. It would help the company reduce the crypto exposure and mitigate the risk of highly volatile price action.

In a separate development, it was reported that FTX sent customer transaction data to the US Federal Bureau of Investigation (FBI). The bankrupt company was forced to share the information following a subpoena from the FBI. Also, last week, a jury found FTX co-founder Sam Bankman-Fried guilty of all seven counts of fraud.

Do you have anything to say about FTX Trust assets or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Top crypto platforms in the US | November 2023

Paybis No fees for 1st swap →

iTrustCapital Crypto IRA →

Coinbase $200 for sign up →

Uphold No withdrawal fee →

eToro $10 for first deposit →

BYDFi No KYC trading →