The recent surge in FTX claims is attributed to its early investment in AI companies, which have jumped in valuation.

The current claim pricing of FTX has reached a maximum of 57%, according to data from Claims Market. The increase in FTX’s claim pricing is attributed to the valuation of artificial intelligence (AI) companies that the now-bankrupt crypto exchange previously invested in.

Creditors stake their claims to try to recoup some of their investment when businesses experience financial difficulties or bankruptcy. Based on estimates of the total amount recovered, investors frequently trade these claims. There is an increase in the estimated recovery value when the pricing of a claim rises.

As the value of FTX’s investment in these AI companies jumped, so did the potential amount that could be recovered from its bankruptcy procedure. A claim is a legal assertion of a certain monetary amount.

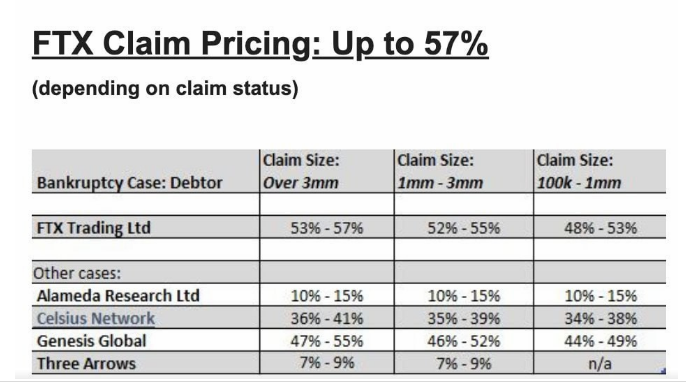

The claim percentage value refers to the percentage of the investment amount expected to be recovered from the platform. FTX claims value has jumped to the highest spot when compared with other bankrupt crypto firms, such as Celsius with 35–40%, Genesis with about 50%, Alameda with 10% and Three Arrows Capital with only 7–9%.

The surge in FTX claims also comes amid former FTX CEO Sam Bankman-Fried’s public trial ending on Nov. 2, with the jury finding him guilty on all seven charges. The judge will announce sentencing in March 2024.

The FTX claims have been a major topic of discussion among the crypto community throughout the bankruptcy proceedings. Earlier, the judge in the case had allowed FTX to sell nearly $3.4 billion worth of crypto assets in the market to compensate creditors. With the rising price of cryptocurrencies and increasing valuation of companies that FTX invested in, the creditors stand a healthy chance of returning a significant chunk of their lost money from FTX.