Ethereum ETFs would open the flood gates of institutional liquidity into the cryptocurrency. The subsequent demand could potentially facilitate a bullish outcome.

- ETH ETF approvals are now closer than ever following the SEC’s acknowledgement of recent applications.

- ETH started to see a resurgence in demand after dipping below $1,600.

ETFs have been a major topic of discussion for the last few months and have mostly revolved around Bitcoin [BTC]. This time, Ethereum [ETH] is the subject of the latest ETF-related development.

How much are 1,10,100 ETHs worth today?

The SEC has reportedly acknowledged review of two ETF applications pertaining to Ethereum. The ETF applications in question were filed by Ark Invest and VanEck.

The acknowledgement might not necessarily be an approval, but it highlights a positive step forward as opposed to a rejection from the regulatory authority.

TRENDING: SEC Acknowledges Review of Two Spot #Ethereum ETF Applications pic.twitter.com/HYf1jbY2VN

— LunarCrush Social Trends (@LunarCrush) September 22, 2023

The above outcome means there is a considerable chance that the two ETH ETF filings might receive approval sometime soon. There will be a 45-day period, during which members of the public will be allowed to issue their opinions regarding the ETFs.

While this does not constitute confirmation that the ETFs will be approved, it points towards a potential positive outcome.

An approval of the Ethereum ETFs would open the flood gates of institutional liquidity into the cryptocurrency. The subsequent demand could potentially facilitate a bullish outcome. The ETH ETFs come at a time when the cryptocurrency has been struggling to secure bullish momentum.

Assessing the prevailing level of demand for ETH

The ETF related development signals that the cryptocurrency could be about to experience a wave of bullish demand towards the end of 2023. However, these expectations are far from reality and are subject to confirmation of approval.

In other words, approval is not yet within the realm of certainty.

Is your portfolio green? Check out the ETH Profit Calculator

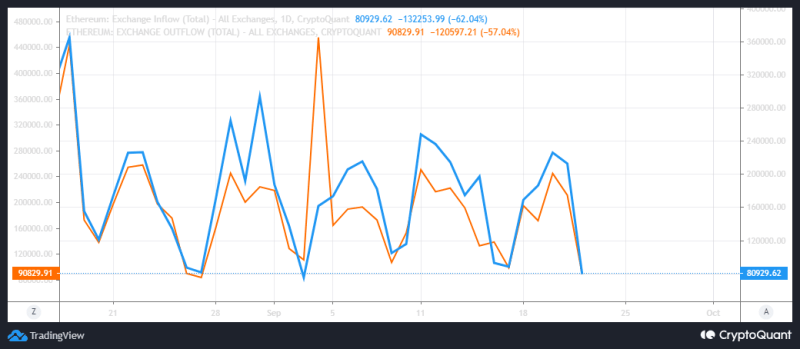

Let’s take a look at ETH’s state of demand. The token was starting to experience higher demand than sell pressure at press time. An assessment of ETH exchange flows revealed that it had higher outflows than inflows in the last 24 hours.

However, the exchange flows have dipped considerably, which aligned with the lack of excitement in the market.

The exchange flows suggest that the bulls might be attempting a gradual take over. However, they were not the only metrics pointing towards such an outcome.

Notably, Ethereum’s active addresses recently registered an uptick in the last 5 days after its previous dip. The same applies to the derivatives segment as the level of open interest soars to a monthly high.

Based on the above findings, it appears that ETH demand is making a comeback. This has been the case in the last three months, each time it dropped below the $16,000 price range.