Despite the activation of ETH withdrawals post-Shanghai, the validator count continues to increase.

- Total ETH staked reached its highest value.

- As positive sentiment waned, the price stagnated within a narrow range.

Ethereum [ETH] validators have deposited $52.3 billion into the ETH2.0 contract to secure the L1 Chain. According to on-chain data provider IntoTheBlock, this marked the highest value it has ever reached.

The Ethereum network is currently being secured by a staggering $52.3 billion, marking the highest value it has ever reached. As the value of #ETH used to secure the network increases, it becomes increasingly challenging for any potential attacker to gain control over it. pic.twitter.com/2hrzj82Nk0

— IntoTheBlock (@intotheblock) July 21, 2023

Is your portfolio green? Check out the Ethereum Profit Calculator

To become a validator on the Ethereum PoS network, validators are required to deposit 32 ETH into the ETH 2.0 contract. As of the time of writing, the total number of ETH deposited into this contract by validators running the network was 27.05 million ETH, per data from Glassnode.

This represented 22.46% of the leading altcoin’s total supply.

State of the PoS network

Validators on the Ethereum Proof-of-Stake (PoS) network are grouped into sets of committees and block proposers for each 32-slot Epoch. A validator on the committee is responsible for producing blocks for each 12-second slot.

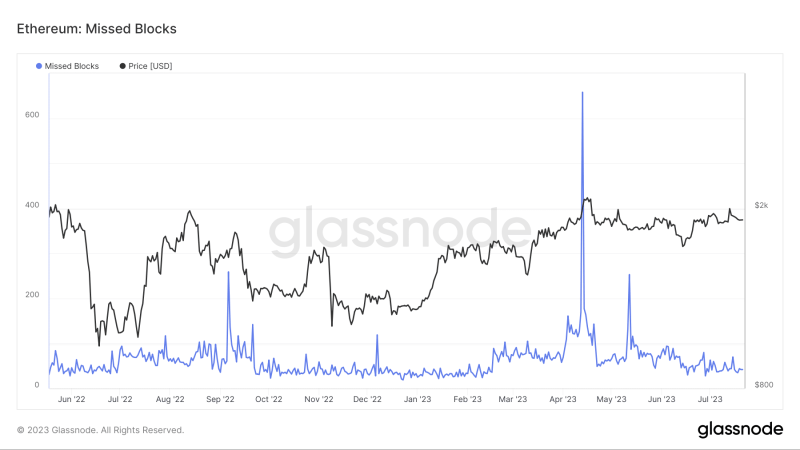

A validator on the committee is charged with the duty of producing blocks for each 12-second slot. However, if the assigned validator is unavailable, it will result in a missed block.

Data from Glassnode revealed that on 13 April (a day after the Shanghai Upgrade), the missed block count touched an all-time high of 658. This could be because some validators intentionally took their nodes offline during the upgrade and a day after it for a proper assessment of the impact of the upgrade.

This, however, soon declined. With only 42 missed blocks recorded on 21 July, missed block count has dropped by 94% since the 13 April high.

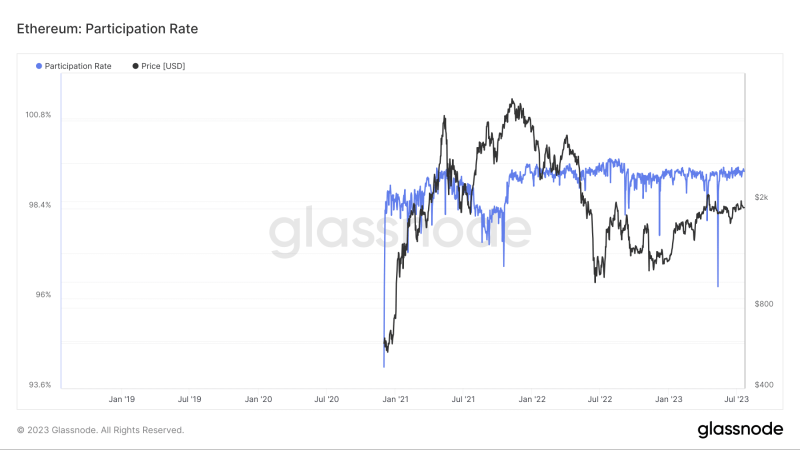

Further, to ensure that the PoS network runs optimally, there has to be a high degree of participation by Validators on the network.

According to Glassnode, a high participation rate indicates reliable validator node uptime and, thus, fewer missed blocks and superior block space efficiency.

On 12 May, validators’ participation rate slipped to its lowest point since December 2020. This dropped to 96%. It has, however, regained its spot at 99%, where it sat at the time of writing. This means almost all the network validators actively participated in block production.

ETH market continues its sideways movement

At press time, ETH exchanged hands at $1,892.25, with its price trading within a narrow range since the middle of the month.

Read Ethereum’s [ETH] Price Prediction 2023-24

The narrow movement of the market was confirmed by the state of the alt’s Bollinger Bands at press time. ETH’s price was positioned by the middle line of this indicator.

When an asset’s price moves in this manner, it suggests that the asset was experiencing a period of relative stability or consolidation at press time. In this situation, there might not be a strong directional trend in the price movement, and the market might be indecisive.