The launch of the ETFs in Hong Kong and optimism around a U.S nod charged Ethereum’s influx.

Edited By: Saman Waris

- Investments worth $30 million were allocated to Ethereum products.

- Bitcoin registered outflows, but ETH’s price might drop.

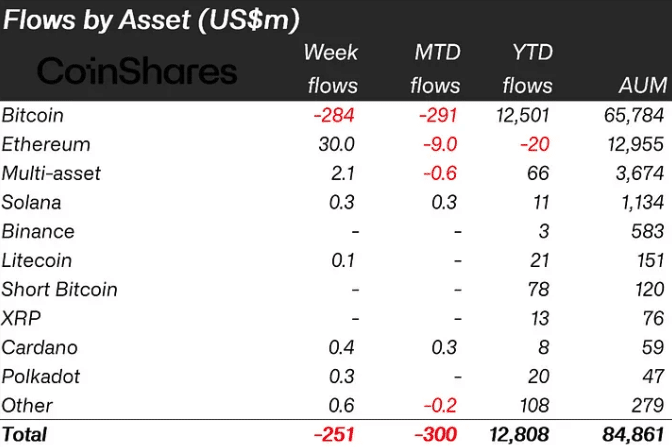

For the fourth consecutive week, digital asset investment products recorded more outflows than inflows. Coinshares, the leading asset manager, made this known in a post dated the 7th of May.

In total, the outflows were worth $251 million with Bitcoin [BTC] accounting for $284 million. However, Ethereum [ETH] was able to reduce that number after it registered inflows worth $30 million.

ETH comes out from the shadows

This was the first time in seven weeks that Ethereum had inflows. However, AMBCrypto observed that the launch of Bitcoin and Ethereum spot ETFs in Hong Kong last week was responsible for the increase.

CoinShares also agreed, highlighting that,

“The bright spot last week was the successful launch of spot-based Bitcoin and Ethereum ETFs in Hong Kong, which saw US$307m inflows in the first week of trading.”

Another reason could be linked to the anticipated decision of the U.S. whether to approve the Ethereum ETF applications or not.

In previous articles, AMBCrypto had reported how some experts expressed skepticism about the approvals.

However, there were a few who displayed optimism that the filing would get the green light. In the week before the last, we had mentioned how Litecoin [LTC] and Chainlink [LINK] led the inflows.

But last week, these altcoins could not find favor in the eyes of investors. For Ethereum, an approval could save ETH from its depressing phase.

On the other hand, rejection could trigger another wave of correction for the cryptocurrency. At press time, ETH changed hands at $3,067.

The coast is not clear

Furthermore, there have been predictions that the price might slide again. If validated, a decline to $2,800 could happen, as it did a few weeks back.

Nonetheless, there are some traders whose target is a return above $4,000. To ascertain the potential of these forecasts, we looked at the Market Value to Realized Value (MVRV) ratio.

The MVRV ratio measures the profitability status of holders. With this metric, one can tell if a cryptocurrency is undervalued, at fair value, or overvalued.

At press time, Ethereum’s 30-day MVRV ratio was -3.447%. This means that holders would generate an average of a -3% loss if they all decide to sell at the current value.

But most would not do this. However, this might not be a good accumulation point, despite the negative reading. Historically, great buying opportunities appear when the metric is between -7% and -18%.

Therefore, those keeping an eye on ETH, and waiting for good entries, might need to wait a little longer.

Is your portfolio green? Check out the ETH Profit Calculator

Regardless of the entry region, ETH would need an intense level of buying pressure to start rewarding the positions.

For now, it is uncertain when that will happen. However, market participants are hopeful that Ethereum’s time to shine might not be far away.