Ethereum’s price has rallied by more than 2% over the last seven days. Amidst this, a whale sold a substantial number of ETH tokens.

- ETH’s RSI and MFI went up last week, supporting its price uptrend.

- However, metrics revealed that selling pressure on ETH was increasing.

Ethereum [ETH] has lifted its price substantially over the last few days. Thanks to that, several investors and whales enjoyed profits. In fact, as per the latest data, a whale made millions of dollars in just a few days.

Though this looked optimistic, a closer look at the scenario suggested that whales might have been expecting ETH to witness a price correction in the days to come.

Ethereum is having a promising bull run

According to CoinMarketCap, Ethereum’s price has been increasing consistently over the last few weeks. In fact, over the last seven days, the king of altcoins’ price surged by more than 2%.

At the time of writing, ETH was trading at $1,805.05 with a market capitalization of over $217 billion.

A look at ETH’s daily chart provided a better understanding of what went in the token’s favor over the last few weeks. Notably, ETH’s MACD displayed a bullish crossover on 20 October 2023, after which the token began its rally.

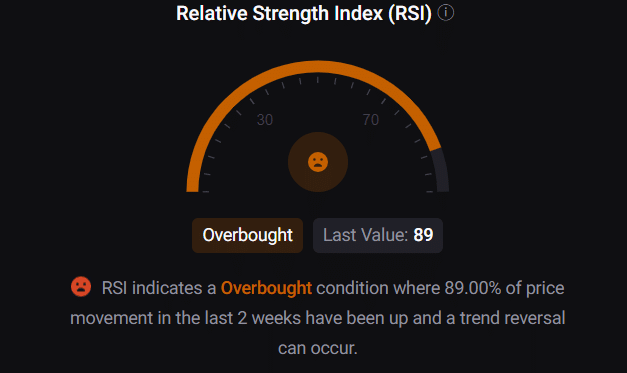

During the same period, its Relative Strength Index (RSI) and Money Flow Index (MFI) also gained upward momentum, supporting the token’s price uptrend. Ethereum’s Chaikin Money Flow (CMF) also turned bullish as it went above the neutral mark over the last few days.

Ethereum’s investors have a reason to worry

Though the latest bull run was quite optimistic for the token, the upcoming days might be different for Ethereum. As per Lookonchain’s recent tweet, a whale made $1.3 million in just two weeks.

The whale spent 8.63 million USDT to buy 5,437 ETH at $1,587 before the price increased on 20 October. Then it sold 5,436 ETH for 9.93 million USDC at $1,827, earning a profit.

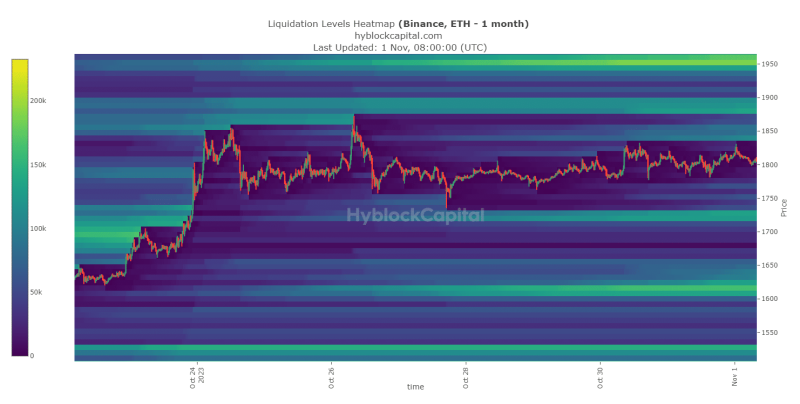

As the whale sold ETH, we must take a look at ETH’s metrics to see whether the token will have a price correction in the days to follow. The token’s liquidation peaked on 26 October when its price touched the $1,8600 level.

Since then, ETH’s liquidation has remained pretty low, as per Hyblock Capital.

However, CryptoQuant’s data revealed that selling pressure on ETH was increasing, which looked concerning. For instance, ETH’s exchange reserve was increasing. Its Korea and Funds Premiums were also red, meaning that Korean and institutional investors were not buying ETH.

On top of that, ETH’s RSI entered the overbought position, which could further exert selling pressure and, in turn, push the token’s price down.