The Ethereum price rally brought out big guns like Alameda, but the trend has reversed.

Edited By: Ann Maria Shibu

- Over 45,000 ETH were deposited to exchanges on 8th April

- ETH has fallen by over 1%.

Ethereum [ETH] experienced a price rise at the end of trading on 8th April. This surge in price coincided with an increase in exchange inflow as Alameda seized the opportunity to capitalize on its holdings.

Alameda dumps more Ethereum

Recent data tracked by Spot on Chain revealed that Alameda Research of FTX deposited Ethereum to the Coinbase exchange. The data indicated that Alameda deposited 4,000 ETH, valued at around $14.7 million when ETH was trading at approximately $3,688.

This deposit marked the first significant move by Alameda since February, coinciding with a rally in ETH prices.

FTX and Alameda have deposited over 21,000 ETH, amounting to more than $72 million. Alameda’s recent move mirrors the pattern observed in the market on 8th February, characterized by a significant influx of ETH into exchanges.

Traders take advantage of the Ethereum rally

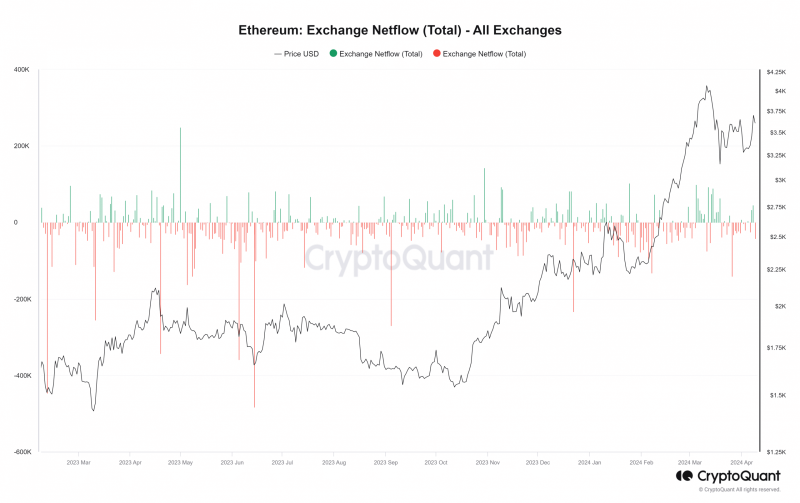

The Exchange Netflow data analysis revealed that Ethereum experienced its highest exchange flow for the month on 8th April. Moreover, the analysis indicated that ETH inflow predominated the flow, indicating that more traders were depositing their holdings onto exchanges.

The chart displayed over 45,000 ETH deposited into these exchanges on 8th April, suggesting that, like Alameda, other traders took advantage of the ETH price rally.

However, there was a reversal in the flow at the time of writing, with more outflow recorded. Over 35,000 ETH have been withdrawn from exchanges thus far. This movement could be attributed to the slight pullback in ETH’s price at the time of writing.

ETH sees 1% decline

On 8th April, Ethereum witnessed a significant surge, marking its largest increase in some time. Analysis of the daily timeframe chart revealed a nearly 7% rise, with ETH closing at approximately $3,694.

Concurrently, the volume chart depicted a substantial increase in ETH volume, exceeding $19 billion as its price surged.

At the time of writing, ETH’s price had experienced a slight decline of over 1%, yet it remained within the $3,600 region.

Read Ethereum (ETH) Price Prediction 2024-25

Despite this decline, Ethereum maintained its current bull trend, as indicated by its Relative Strength Index.

Additionally, analysis of its volume indicated an uptick. At the time of this writing, the volume was over $20 billion, reflecting ongoing market activity and investor interest in Ethereum.