10 Years of Decentralizing the Future

May 29-31, 2024 – Austin, TexasThe biggest and most established global hub for everything crypto, blockchain and Web3.Register Now

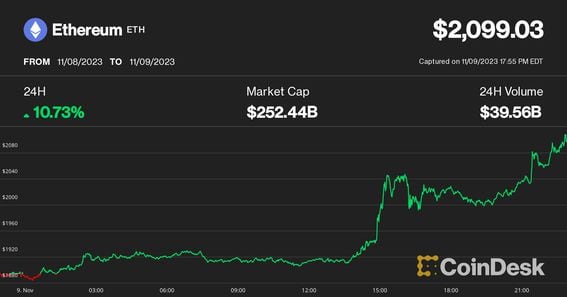

- ETH soared 10% to near $2,100 after a Nasdaq filing confirmed BlackRock’s plan to file for an ETH-based ETH.

- BTC recently changed hands at $36,600, up 3% during the day.

- Most of the rest of cryptocurrencies suffered declines as rotation to altcoins halted amid ETH, BTC strength.

Ether (ETH) stole the spotlight from bitcoin (BTC) Thursday as asset management giant BlackRock (BLK) laid the groundwork to list an ETH exchange-traded fund.

ETH surged past $2,000 early U.S. morning hours from below $1,900 after a filing showed a corporate entity named “iShares Ethereum Trust” had been registered in the state of Delaware – the legal home of many U.S. businesses. Something similar happened in June with BlackRock’s iShares Bitcoin Trust – the Delaware corporate registration came just before the actual ETF application.

History repeated itself Thursday. Hours after the Delaware filing, a Nasdaq filing confirmed BlackRock’s plan for an ether-focused ETF.

Bitcoin hit a fresh 18-month high price, soaring to just shy of $38,000 from around $35,000 in a short squeeze early morning BlackRock ETH news, though, BTC saw a sharp reversal, sinking to around $36,300.

ETH was up 10% over the past 24 hours, while BTC advanced 3% over the past 24 hours.

Altcoins plunge like XRP, DOGE UNI and XLM

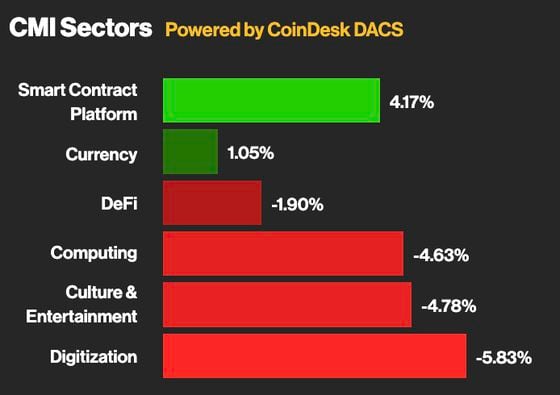

While ETH and BTC showed strength, most alternative cryptocurrencies – altcoins – retreated during the day, paring back their gains from the previous days as capital rotation to smaller tokens seemingly halted.

Ripple’s XRP, dogecoin (DOGE), uniswap (UNI) and Stellar’s XLM declined 6%-7%, while toncoin (TON) pulled back 10% after its over 20% rally over the past week.

Governance tokens of top ETH liquid staking platforms defied the plunge, with Lido’s (LDO) and RocketPool’s (RPL) rising 18% and 23%, respectively.

The divergence between the two largest crypto assets and the rest of the market was visible in the performance of the CoinDesk Market Index (CMI) sectors. Only the ETH-heavy Smart Contract Platform sector and BTC-led Currencies sector booked gains during the day as the rest of the crypto sectors plummeted.

The altcoin weakness was perhaps buoyed by a generally risk-off day on traditional markets after Federal Reserve Chair Jerome Powell said the central bank won’t hesitate to hike interest rates if necessary, pouring cold water on expectations of a more dovish monetary policy.

U.S. equities tumbled, ending their winning streak with the S&P 500 and Nasdaq indexes down almost 1%.

Why BlackRock’s ETH ETF application is important

Market observers opined that a spot BTC ETF, if approved, could attract sophisticated investors who previously couldn’t or didn’t feel comfortable to buy crypto. While there are several futures-based bitcoin and ether ETFs on the market, they are deemed inferior products due to rollover costs.

“If act one is a spot bitcoin ETF, then act two is a spot ether ETF,” said Diogo Monica, president of federally chartered digital asset bank Anchorage Digital.

“A spot ETH ETF would have a similar impact as a BTC counterpart, providing a regulated and accessible wrapper for institutions and consumers to participate in the ETH ecosystem,” he explained in an emailed note.

“But Ethereum adds an extra layer of intrigue as a proof-of-stake asset, which means underlying ETH could also be staked for additional rewards,” he added.

Edited by Nick Baker.