DOGE should hold on to its current levels for the broader sentiment to stay bullish.

Edited By: Saman Waris

- DOGE recorded double-digit losses amidst the broader market bloodbath.

- Whales were seen accumulating DOGE at a discount.

The crypto market bled heavily in the last 24 hours, bogged down by massive selling of blue chip currencies like Bitcoin [BTC] and Ethereum [ETH].

The contagion spread to the world’s largest memecoin, Dogecoin [DOGE] as well.

The original dog-themed token sank more than 10% in the last 24 hours of trading, broadening its weekly losses to 20%, and monthly losses to more than 38%, data from CoinMarketCap showed.

The price drop triggered liquidations of more than $15 million in DOGE positions in the derivatives market, AMBCrypto noted using Coinglass’ data.

Litmus test for DOGE

Noted crypto trader and commentator Kevin took to X to underline the significance of DOGE’s current price levels.

He stated that the 12.5–13 cents level was a major support zone and DOGE should ideally hold it for the sentiment to stay bullish. Kevin said,

“If we do lose this zone then we will re assess this market.”

Whales have other plans

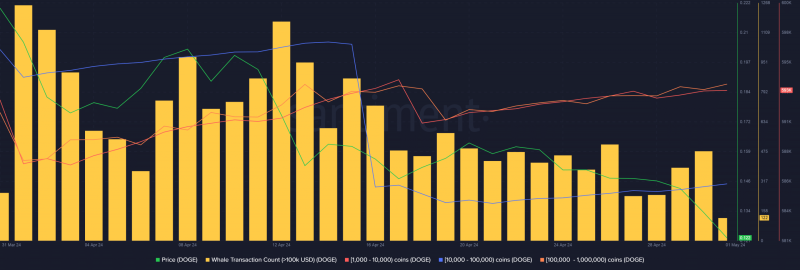

Meanwhile, whales stepped up their game as the prices dropped. According to AMBCrypto’s analysis of Santiment’s data, large transactions, worth more than $100,000, increased in the last two days.

Alongside this, addresses belonging to cohorts holding between 1,000 and 1 million coins were seen rising. The findings from these two metrics suggested that wealthy investors were dip-buying DOGE.

The bullish interest was also reflected in the long exposure of whales.

As per AMBCrypto’s analysis of Hyblock Capital data, the percentage of whale positions longing DOGE increased from 72.9% to 74.85% in the last 24 hours.

Clearly, whales know something about DOGE that we don’t!

Realistic or not, here’s DOGE’s market cap in BTC terms

Negative sentiment persists

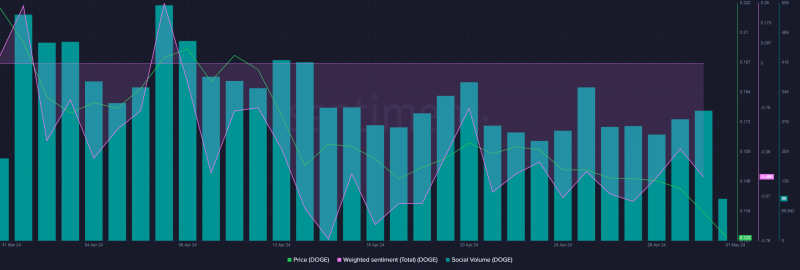

DOGE’s social activity also rose in the last 24 hours, as shown by an increase in the mentions of the coin on top crypto-focused channels.

However, most of the commentary was pessimistic on its prospects, as the Weighted Sentiment trended in the negative territory.