STRK’s market movement is closely tied to ETH’s performance, but that’s not the only point.

Edited By: Saman Waris

- STRK’s price resisted a major decline after millions of tokens went into exchanges.

- Indicators suggested that the value could drop amid falling volume and rising volatility.

Two of the largest Starknet [STRK] holders might have put the price at risk of a decline, but data showed that STRK seems to be holding on well.

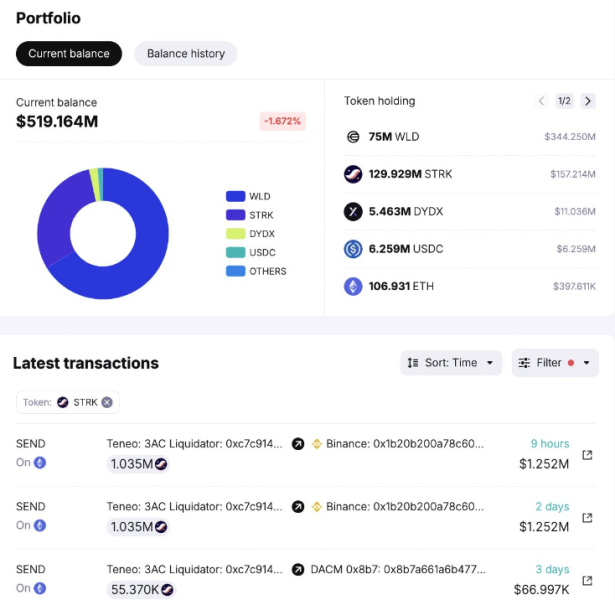

On the 25th of May, AMBCrypto discovered through Spot On Chain that Tenoe, a Three Arrows Capital (3AC) liquidator, deposited 2.18 million STRK into Binance.

How ETH secured STRK’s Freedom

Large exchange deposits like this are supposed to precede a price decrease. But the Starknet token did not budge.

At press time, the price of the cryptocurrency was $1.25, representing a 4.06% increase in the last 24 hours.

Before Teneo’s deposit, Ethereum’s [ETH] co-founder Vitalik Buterin claimed his 845,000 STRK airdrop, worth $1.07 million. This action affected the token’s value as it dropped by 6%.

However, it seemed that Starknet did not react the same way because of the U.S. SEC’s approval of Ethereum spot ETFs. Before the confirmation and afterward, ETH, including native tokens of Layer-2 projects under its blockchain, pumped.

For the uninitiated, Starknet is one of the notable Ethereum L2s.

As such, it seemed that the bullish sentiment around the ecosystem was the major reason the latest sale did not send STRK plunging.

Where is next? $1.06 or $1.50?

Furthermore, AMBCrypto looked at the Weighted Sentiment around Starknet. At press time, the metric had surged to 4.293. Weighted Sentiment measures the positive/negative commentary about a cryptocurrency.

Therefore, the reading implied that for every negative mention of STRK, there were four more supporting a bullish cause. Should the sentiment remain optimistic, the price of the token might continue to rise.

In a highly bullish case, the value of the STRK might hit $1.80. However, a return to the bearish phase could cause STRK to move to $1.06.

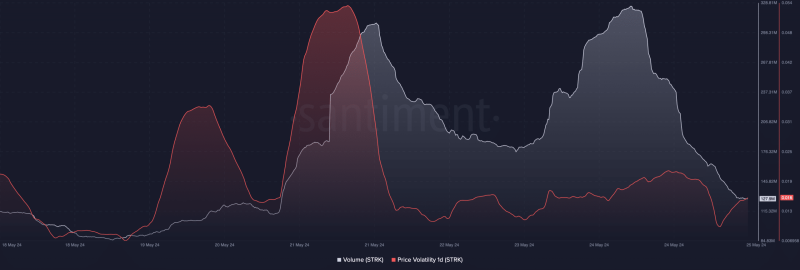

However, the bullish price prediction might be invalidated according to signals from the volume. As of this writing, STRK’s volume was $127.90 million.

This was a notable decline from the figure on 24 May. Volume can be a sign of interest in a token and market strength. Therefore, increasing volume is viewed as a healthy metric for price.

Thus, Starknet’s declining volume while the price rises suggests the upswing might not last. Validation of this forecast could bring the token’s price down, and the slide to $1.06 could come to pass.

Meanwhile, volatility around the cryptocurrency increased, suggesting notable price fluctuations.

But the reading, according to Santiment, showed that it might not be enough to spur a move that saw STRK move past $1.50 some weeks ago.

Realistic or not, here’s STRK’s market cap in ETH terms

Regardless of the signals on-chain, market participants might need to keep an eye on ETH.

If the prediction that ETH might hit a new high comes to pass, STRK might follow in the same direction. But if the altcoin fails to rally, its beta might also struggle.