The crypto market’s response to July’s macroeconomic indicators reflects the complex interplay between a potential U.S. economic soft landing, court rulings, technological advancements and Federal Reserve policy.

July’s crypto landscape found itself closely intertwined with the broader financial markets, mirroring the hopes and realities of the U.S. economy’s potential soft landing, according to a Grayscale report.

July’s cryptocurrency trends seemed to mirror the larger economic sentiment surrounding the prospects of a soft landing for the U.S. economy, Grayscale reported. With recent data pointing toward low inflation and consistent growth, the risk of recession appeared to diminish:

“However, a soft landing is not assured, and is now increasingly a consensus view–and therefore already discounted to some degree by markets […] If incoming economic data continue to support the soft landing thesis, the year-to-date rebound in major token valuations can continue. But if the economy stumbles or the Federal Reserve raises real rates further, the crypto recovery may pause over the near-term.”

The Federal Reserve’s comments during the July FOMC meeting further signaled confidence in the economy, reinforcing these market sentiments:

“The Federal Reserve Board staff no longer predict a recession in their forecasts, while redirecting when he was asked about guidance the Fed previously shared in June noting that at least one more rate increase was planned for later in 2023.”

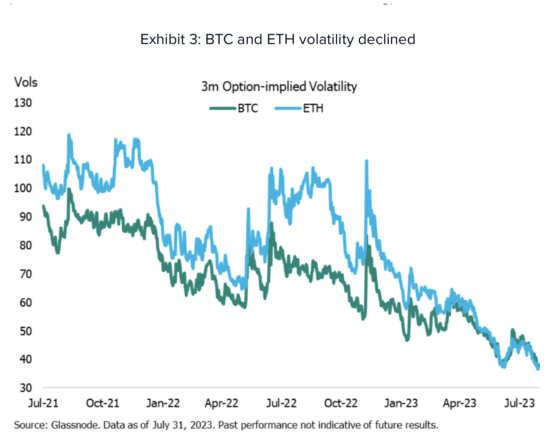

While Bitcoin remained relatively steady, other risky assets, including U.S. regional bank equities and crude oil, performed well. However, cryptocurrencies like Ethereum showed more volatility, particularly after a security incident involving the Curve protocol.

One of July’s significant events was the U.S. District Court ruling on SEC v. Ripple Labs. The nuanced judgment, which saw XRP’s price doubling, emphasized the intricacy of defining digital assets legally, impacting several other tokens and reflecting broader market dynamics:

“Compared to earlier this year, there were also fewer Bitcoin-specific drivers, like concerns around regional banks (in March 2023) and optimism about spot ETF approval (in June 2023).”

Several digital assets, like MakerDAO’s MKR token, Uniswap, and Chainlink, benefited from technological enhancements, underlining the industry’s propensity for innovation. Additionally, Worldcoin’s listing on select exchanges further showcased the market’s ability to evolve and adapt.

Other notable trends included a decline in Bitcoin fees and an increase in alt-coin dominance. Events like the XRP ruling and the launch of AI tools seemed to both challenge and drive the crypto space, illustrating a multifaceted market, the report stated.