Latest crypto news: The Avalanche Foundation (AVAX) launches the “Vista” incentive program that will grow the tokenized asset sector on blockchain.

A total of $50 million has been allocated in a fund dedicated exclusively to the purchase of digital assets minted in the Avalanche ecosystem.

What does all this imply to the future price of AVAX crypto?

Let’s look at all the details below.

The Avalanche Foundation (AVAX) and its commitment to promoting the crypto ecosystem with a $50 million initiative

Yesterday, the Avalanche Foundation announced the launch of “Vista,” an initiative directed at the economic support of its crypto ecosystem, with an incentive program dedicated to the niche of tokenized assets on blockchain.

The intent is to fortify its network by allocating $50 million to purchase assets minted on Avalanche that include different asset classes such as bonds and stocks, credits, commodities, real estate and more.

The benefits of the practice of tokenization are many: it fosters greater liquidity and accessibility by investors around the world, while offering reduced transaction costs and speed of operations.

With this new technological practice, one can even “fractionalize” an asset (whether physical or digital), into multiple parts allowing the creation of a different market than the original one: for example, by fractionalizing the ownership of a famous painting through cryptographic tokens, one can have many small owners of the artwork rather than a single tycoon.

Many traditional financial institutions such as Bank of America or BlackRock have also recognized the potential of asset tokenization on blockchain, hinting that this niche could grow tremendously in the coming years.

In this regard, the consulting firm Boston Consulting Group has predicted that this sector will reach $16 trillion by 2030.

Avalanche Foundation’s initiative reflects its team’s commitment and seriousness in pursuing the development of its decentralized world.

The Vista program came on the heels of another major project run on Avalanche’s blockchain, namely the tokenization of part of the KRK private equity fund through the collaboration of the company Securitize.

Already in 2021, the same foundation participated in an investment program for the DeFi world together with Curve and Aave by allocating the huge sum of $180 million.

These are the words of the Avalanche crypto project team:

“The $50 million allocation reflects the Avalanche Foundation’s commitment to promoting a more accessible, efficient and cost-effective financial system through the use of Avalanche’s new consensus mechanism, unique sub-network architecture and technical innovation. It intends to accelerate the growth of tokenization and its role in on-chain finance by demonstrating the merits of applying blockchain guides to historically more manual and operationally intensive use cases, including asset issuance, settlement, transfer and administration.”

On-chain data analysis of the Avalanche network

Let’s now try to analyze the on-chain data of the Avalanche network and crypto AVAX to understand how the infrastructure is performing and whether it is making progress.

On the TVL front, we can say that blockchain still plays a key role in the industry’s top layer 1 landscape, with a total blockchain value of $641 million.

In that sense, Avalanche ranks seventh as the network with the most capital in it, behind only established entities such as Ethereum, Tron, BSC, Arbitrum, Polygon and Optimism.

Unfortunately, the network is far from matching the bull run numbers of 2021, where more than $10 billion were deposited by users on the network’s various decentralized applications.

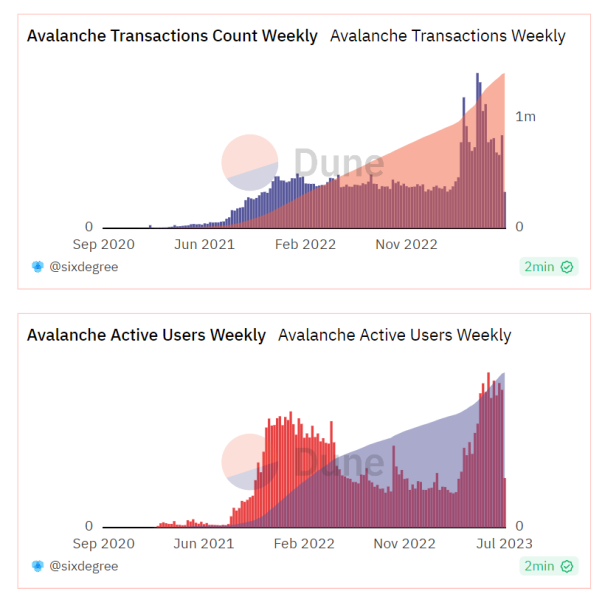

On the internal activity front, it is interesting to note that both the number of transactions and the number of active users, both on a weekly basis, have been growing strongly since March 2023.

In particular, transactions conducted on Avalanche during this period tripled while the number of active addresses quadrupled.

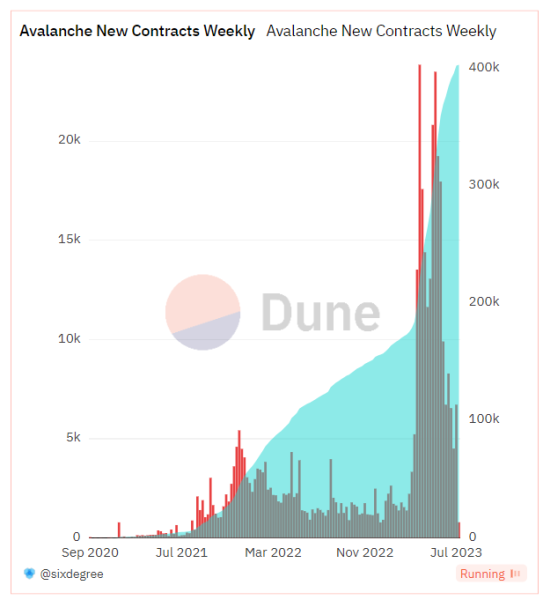

Very interestingly, we also see a huge increase in the number of smart contracts entered into on the network in the same time frame

From mid-March through June we can count a number of new weekly contracts exceeding 10 thousand, with the trend fading in recent weeks.

Altogether on Avalanche we can find a beauty of 402 thousand contracts, in an ecosystem rich in applications with different use cases and a large number of developers supporting them.

Focus on the price of the Avalanche (AVAX) crypto

The overall pricing situation for AVAX crypto seems to be in line with the movements of the TVL of the decentralized Avalanche network.

The crypto token is on the same value range seen in the pre bull market phase of 2021 with a bearish trend that has lasted for over a year now.

The bear market of 2022 has undone all of the previous strides that had been recorded, both in terms of AVAX and the inflow of capital on the Avalanche ecosystem.

While remaining one of the most thriving institutions in the crypto world, this project highlights the need to find new impetus and new players ready to kick the liquidity environment into high gear.

Focusing mainly on prices, we can say that at the moment there seems to be no reason to think of any particular movement on the horizon.

The crypto trades at $13.26, failing to emerge above the 10-period exponential moving average on a weekly time frame, a signal that suggests a lack of stimulus for the bulls, which the bears still maintain control of.

Avalanche (AVAX/USDT) weekly price chart

Until AVAX can break above the EMA 60 or indicatively the $20 price level, we will have no signs of a bullish restart.

At the moment, the odds play for a prolonged distribution-laterality for the next few months.

The native token in the Avalanche network has a market capitalization of $4.58 billion distributed across five different chains, with trading volume of $143 million in the last 24 hours.