Contents

- 1 6 objections to the New York Agreement

- 2 The New York Agreement: Less than the total of its parts

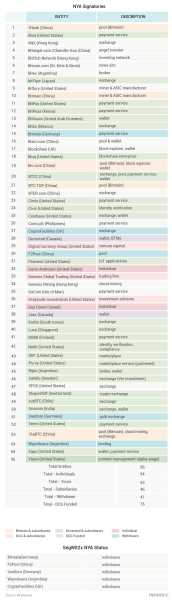

- 2.1 The total number of companies that signed the New York Agreement is 56

- 2.2 The total number of signatories minus individuals is 54

- 2.3 The total number of signatories, excluding individuals and “Yours” is 53

- 2.4 The total number of signatories, excluding the foregoing and subsidiaries is 46

- 2.5 The total number of signatories, excluding the above listed companies and firms that have withdrawn their signatures is 41

- 2.6 The total number of signatories, excluding the above listed companies and companies financed by DCG is16

- 3 How to prepare for the split

- 4 Changes to the hash rate and block formation time

- 5 Bitcoin Gold has nothing to do with SegWit2X

- 6 Keep calm and have your private keys with you

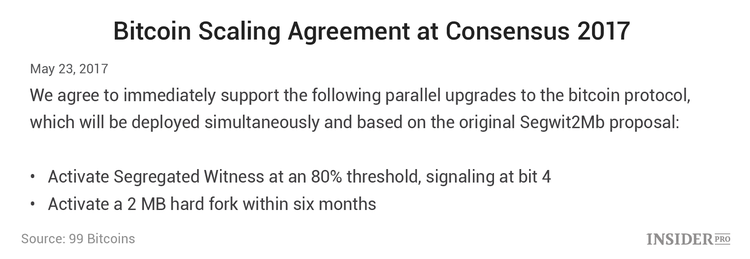

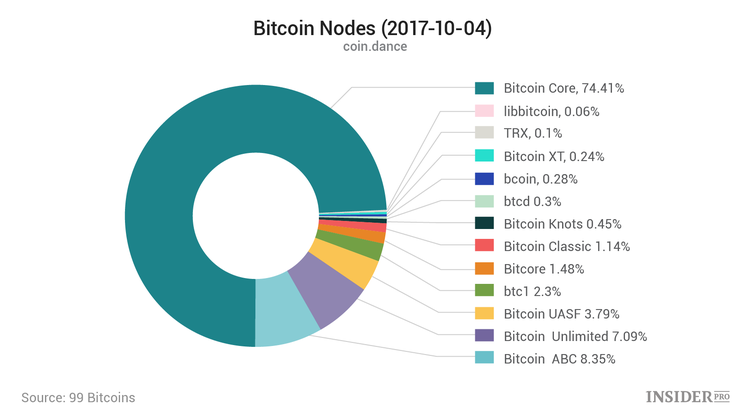

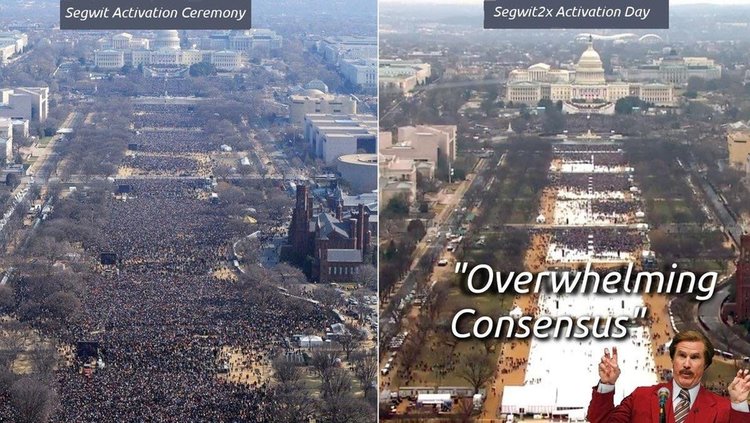

Who is against the activation of SegWit2x, is Bitcoin Gold associated with it and how should those who have bitcoins prepare? We tell you everything. A few months ago, following some extensive debates, SegWit, an updated bitcoin protocol (EXANTE: Bitcoin) was initiated. As a result of these debates, an alternative Bitcoin Cash cryptocurrency (EXANTE: Bitcoin.Cash) was created as an opposition to SegWit. We are now on the threshold of another split and that is SegWit2x. The SegWit protocol was made under one condition: an increase in the block size within three months, meaning the hard fork. The miners, who did not support SegWit in the beginning, activated it under the New York Agreement (NYA) terms. This agreement is also identified as the Silbert Agreement or the DCG Agreement called after its initiator, Barry Silbert, the founder of Digital Currency Group. Many prominent players in the cryptocurrency market, including the Bitmain Mining Company, the Coinbase exchange, and the BitPay payment system were attracted by Silbert. The use of SegWit soft work is gradually growing, and this is in favor of the network (for example, reduced fees). Further improvements have been virtually approved, the most important of which is the development of the Lightning Network system. Now everyone is worried about the second part of the New York Agreement, which implies an increase in the size of the block and hard fork next month. The hard fork is designated as SegWit2x or S2X. The btc1 protocol for the activation of S2X was created by the former Core developer and the head of Bloq Jeff Garzik. Its activation will occur at the block 494 784. The time remaining before the activation of the protocol is shown on the 2xCountdown website. Considering the comments in various social networks, members of the bitcoin community are extremely unhappy with the New York Agreement. Many Twitter users express their disagreement with the #NO2X hashtag. If you need a more weighty evidence, look at the share of nodes (currently 97.7%) that have not switched to the btc1 protocol: Delusional man thinks he can dictate when a $75 b network upgrades even though no one is running his software. #No2x #NotTheOnion https://t.co/MuT6WnEDeW — Samson Mow [NO2X] (@Excellion) October 8, 2017 These are the main objections to the New York Agreement: By studying the list of companies registered in the New York Agreement, you can find several interesting facts. To begin with, let’s recount the signatories. At first sight, this is a very impressive number, but it does not stand up to a thorough verification. Moreover, the number of companies that have withdrawn their signature or who have never signed this agreement is much higher. However, it cannot be said that we know the full list of opponents of the New York Agreement, since many companies have not indicated their position at all. Also it is not known how many miners will leave the pools, which will not perform operations in the chosen blockchain. Of the total number of signatories, you can safely subtract two people: a former Core developer Gavin Andresen, and the former president of the bankrupt manufacturer of ASIC-miners Spondoolies, Guy Corame. Since none of them is an active developer or a CEO, their participation in SegWit2x does not go beyond a PR support or a possession of the node. This makes them regular bitcoin users like millions of others. The startup of Ryan Charles “Yours” has signed the New York Agreement, but a week before that Charles announced that he switched from bitcoin to litecoin (LTC/USD). That is, “Yours” does not really participate in the future of bitcoin, and his signature may be annulated. Of the total number of companies that have signed the New York Agreement, you can also deduct subsidiaries: SegWit.Party shows revised statistics related to S2X support, including all the links, if the position of a particular company has changed. According to them, 7 participants of the New York Agreement publicly withdrew their signatures. If you deduct the companies that got funding from the Digital Currency Group from the total number of signatories (see the Portfolio page on the DCG website), then there are only 16 companies left. Considering that in many cases DCG is the majority investor of these companies, they can, in fact, be equated with the subsidiaries. The last figure is the most controversial, since in many cases we do not know the amount of investments received from DCG and, accordingly, the degree of influence of DCG on these companies. It is possible that some of them can make decisions completely independently of DCG. 99 Bitcoins Those users who have survived the Bitcoin Cash hard fork should know what to anticipate. The number one step is to transfer all the coins to a wallet, which is completely under your control. In other words you need to withdraw all your cryptofunds from exchanges and other web wallets. Double check that you have access to your private keys. With the approach of the hard fork, exchanges will publish statements on how they will cope with the situation (see, for example, the statements of Coinbase and Bitfinex). However, this time there will be one chief difference compared to the previous hard fork, due to the fact that there is a lack of replay protection, it will be unsafe to spend your coins. We highly recommend all bitcoin users not to fuss and wait for concrete instructions. Perhaps, users and companies will have to manually separate their coins, even though it is not clear how this will work. We also recommend to refrain from making transactions shortly before and after the split and wait for a signal that everything has returned to normal. According to some leaked unconfirmed reports, some large miners are going to completely redirect the hash rates to S2X and possibly attack other blockchain. Although a strong fall of the hash power may lead to a delay in transactions and the growth of the commission, the market will come to balance over time. Bitcoin Gold is another hard fork planned for October 25th, read about more about it in our future articles. The upcoming November hard fork is, in fact, the same old story. Remember to keep your private keys close at hand and abstain from conducting transactions until everything comes back to normal. The main question everybody asks is what will happen to the Bitcoin? No one knows for sure. This is another episode from the life of the “free market”, which we all have to experience ourselves. 99Bitcoins

6 objections to the New York Agreement

The New York Agreement: Less than the total of its parts

The total number of companies that signed the New York Agreement is 56

The total number of signatories minus individuals is 54

The total number of signatories, excluding individuals and “Yours” is 53

The total number of signatories, excluding the foregoing and subsidiaries is 46

The total number of signatories, excluding the above listed companies and firms that have withdrawn their signatures is 41

The total number of signatories, excluding the above listed companies and companies financed by DCG is16

How to prepare for the split

Changes to the hash rate and block formation time

Bitcoin Gold has nothing to do with SegWit2X

Keep calm and have your private keys with you