Coinbase’s new institutional lending service has the same operating entity as Coinbase Borrow, which halted the issuance of new loans in May.

Cryptocurrency exchange Coinbase has rolled out a crypto lending service for institutional investors in the United States, reportedly aiming to capitalize on massive failures in the crypto lending market.

Coinbase has quietly launched an institutional-grade crypto lending platform, Coinbase Prime, to U.S. investors, according to a Bloomberg report on Sept. 5. Coinbase Prime is a full-service prime brokerage platform that lets institutions execute trades and custody assets.

“With this service, institutions can choose to lend digital assets to Coinbase under standardized terms in a product that qualifies for a Regulation D exemption,” the firm reportedly said in the statement.

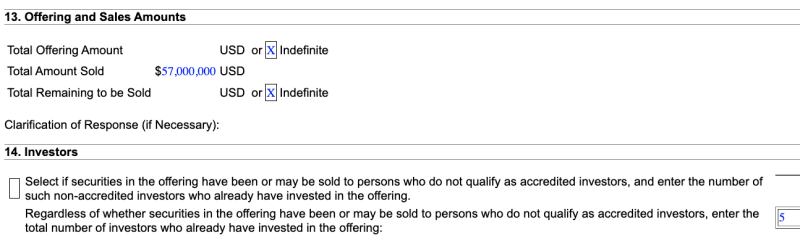

According to a filing with the U.S. Securities and Exchange Commission, Coinbase customers have already invested $57 million in the lending program since the first sale occurred on Aug. 28. The offering had attracted five investors as of Sept. 1.

Coinbase did not immediately respond to Cointelegraph’s request for comment.

The new crypto lending product by Coinbase follows the halt of new loan issuance on Coinbase Borrow in May 2023. The program is designed to allow users to receive up to $1 million through Bitcoin (BTC) collateral. The new institutional program is operated through Coinbase Credit, the same entity that manages Coinbase Borrow.

The news comes months after the U.S. SEC charged Coinbase with alleged offering and sale of unregistered securities in connection with its crypto starking services, which allow users to earn yields on giving their crypto to the platform. The exchange opposed the SEC’s allegations, arguing that it strongly disagreed with any allegations that its staking services were securities.

Coinbase eventually had to pause its staking program in four states — California, New Jersey, South Carolina and Wisconsin — while the proceedings were going forward.

The crypto lending industry was hit with a massive crisis last year, with major companies like BlockFi, Celsius and Genesis Global going bankrupt amid a lack of liquidity caused by the bear market of 2022. Some crypto enthusiasts said that the crypto lending sector must learn lessons from the collapses and solve issues related to short-term assets and short-term liabilities.