Africa is silently weaving a narrative that might shape our world’s monetary future. CBDCs have taken center stage, and while advanced economies debate their adoption, many African nations are racing ahead.

Africa’s Unbanked Shift From Mobile Payments to CBDCs

The story of Africa’s technological evolution is both compelling and unique. Skipping the era of landlines, the continent plunged directly into the mobile age. This transition was not just technological — it reshaped societies.

Platforms like M-Pesa brought financial access to corners of the continent previously untouched by traditional banking.

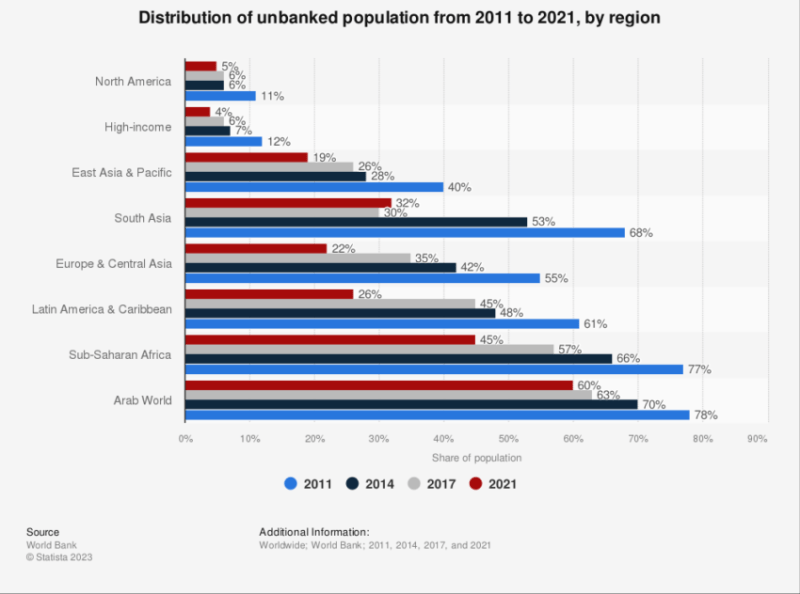

Indeed, traditional banking left gaps in Africa. Although the average rate of account ownership in the region increased to over 70%, approximately 350 million adults, from the bustling markets of Lagos to the serene coastlines of Madagascar, are untouched by formal financial systems.

“In Sub-Saharan Africa, [the increase in the average rate of account ownership] was largely due to the adoption of mobile money… Mobile money has become an important enabler of financial inclusion in Sub-Saharan Africa — especially for women — as a driver of account ownership and of account usage through mobile payments, saving, and borrowing,” reported the World Bank.

Unbanked Population Worldwide. Source: Statista

Now, the winds of change carry whispers of another digital transformation powered by CBDCs.

CBDCs, with their promise of stability and digital ease, beckon these vast numbers into a new monetary age. Instead of the wild swings of decentralized cryptos, CBDCs offer a balanced blend — digital advantages under a regulated, government-backed umbrella.

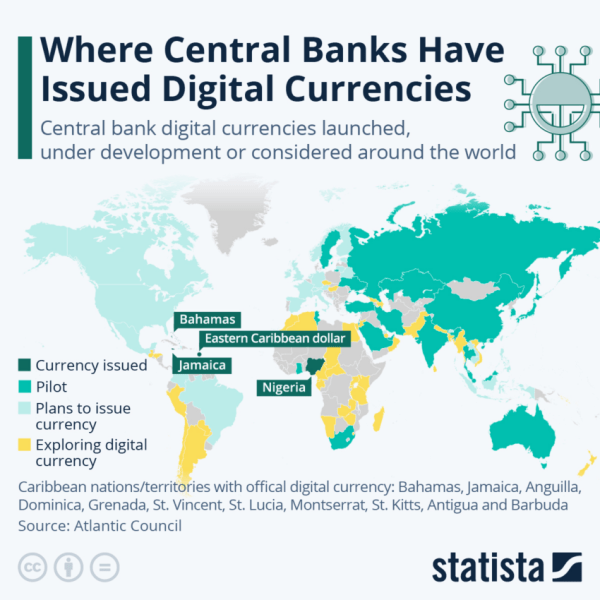

African Nations Making Significant Strides to Adopt CBDCs

Nigeria’s journey with its digital currency, eNaira, serves as an illustrative tale of CBDC adoption in Africa.

Launched in 2021, the digital currency faced skepticism. Fast forward to today, the landscape looks different — over 13 million wallets transacting more than $47.7 million.

“The eNaira has emerged as the electronic payment channel of choice for financial inclusion and executing social interventions,” said Godwin Emefiele, the Central Bank of Nigeria’s governor.

The eNaira is no longer a digital token but an instrument of welfare, financial inclusivity, and policy. By intertwining the eNaira with welfare initiatives, Nigeria’s government is not only distributing assistance. It is weaving a new societal fabric where the unbanked feel included.

However, this is not just Nigeria’s narrative.

CBDC Adoption Worldwide. Source: Statista

Venture westwards, and Ghana’s experiments with the e-Cedi come into focus. While still in its infancy, the e-Cedi underscores Ghana’s ambition to utilize digital tools for societal good.

Back to the east, Kenya, a nation already acclaimed for its M-Pesa success, mulls over the possibilities of a digital shilling. This is not mere contemplation but a nation’s intent to optimize its financial landscape.

And in the south, whispers of a digital rand by South Africa echo its aspirations — not just to digitize currency but to potentially reshape financial structures, remittances, and even monetary policy mechanisms.

“CBDCs are an entirely different matter. In our view, wholesale CBCDs are potentially useful. They could exploit the self-verifying properties of blockchain to simplify inter-bank clearing. We also think retail CBDCs could serve a social purpose, particularly by increasing participation in the formal financial system, and by reducing opportunities for tax evasion and other forms of financial crime,” said Sim Tshabalala, Chief Excecutive at Standard Bank, a major South African bank.

The Challenges CBDC Adoption Faces in the Region

Yet, the transformative journey of CBDCs is not devoid of challenges. Infrastructure remains a significant hurdle. For CBDCs to be ubiquitous, they need a foundation — steady internet access, an informed populace adept in digital tools, and an iron-clad cybersecurity assurance.

Furthermore, for a population that has, for generations, remained outside formal banking’s fold, trust in a new centralized digital entity does not come easy. Rumors, misinformation, and inherent skepticism about governmental digital initiatives might pose roadblocks.

While CBDCs can redefine transactions and banking, they can also disrupt existing monetary systems. Central banks’ response to this — whether by tweaking interest rates, influencing lending practices, or partnering with private entities — remains a space to watch.

There is a reason the world’s financial eyes are trained on Africa. If Africa’s CBDC experiment succeeds, it can provide a template for other emerging economies grappling with similar challenges. If it stumbles, the lessons are invaluable, shaping global approaches to digital currencies for decades.

The larger narrative here goes beyond just CBDCs. It is about a continent continually reinventing itself, drawing from its rich past, facing its challenges head-on, and looking to a promising future.