The uptick in ADA’s value in the last month has led to a resurgence in whale interest in the altcoin.

- ADA’s whale activity has reached its highest level since the year began.

- Key indicators on the daily chart confirm the strength of the ongoing rally.

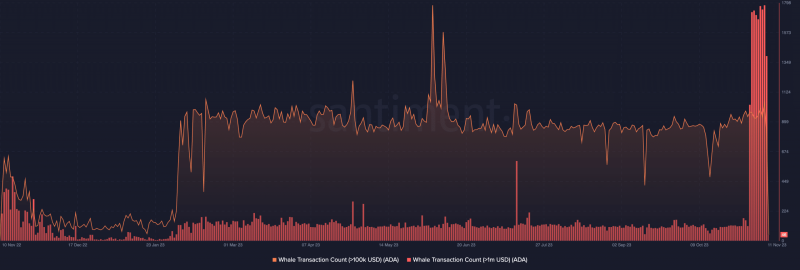

The daily count of Cardano [ADA] whale transactions exceeding $1 million has reached its highest level so far this year amid the current rally.

On 9th November, the number of ADA transactions above $1 million totaled 2192. Likewise, ADA saw its highest daily transaction count in the past six months for transactions exceeding $100,000.

The data from on-chain analytics firm Santiment shows that the number of large-value ADA transfers has steadily increased in recent weeks, coinciding with a 50% surge in the token’s price over the past month.

The bulls hold on firmly

Readings from the coin’s Average Directional Index (ADX) assessed on a daily chart put the indicator’s value at 57.46 at press time.

An ADX value above 50 with a corresponding growth in an asset’s price signaled that the current market uptrend is strong.

Moreover, the coin’s positive directional index (green), at 33.19, rested above the negative directional index (red) at 3.74. This meant that buying activity outpaced coin distribution among traders in ADA spot markets.

Also, the recent price rally has pushed ADA’s Chaikin Money Flow (CMF) to its highest level since January. This indicator assesses the flow of money into or out of an asset and offers insights into the buying and selling pressure in the market.

A positive CMF suggests buying pressure, while a negative CMF indicates selling pressure.

At 0.34 at press time, ADA’s CMF showed that the coin’s market was being supplied with a significant volume of liquidity needed to sustain the rally.

Likewise, key momentum indicators maintained an uptrend and were positioned above their neutral lines. ADA’s Relative Strength Index (RSI) was 77.69, while its Money Flow Index (MFI) was 80.47.

At these values, these indicators showed that ADA accumulation significantly exceeded distribution. However, these levels are often marked by buyer exhaustion, followed by a price correction; hence, caution is advised.

How much are 1,10,100 ADAs worth today?

The coin’s open interest in the futures market was $149 million, its highest point in the past five months. As per Coinglass data, ADA’s open interest has shown a consistent increase since 21 September, rising by 53% during this period.

When an asset’s open interest grows in this manner, it means that more active contracts or positions are being held by market participants.