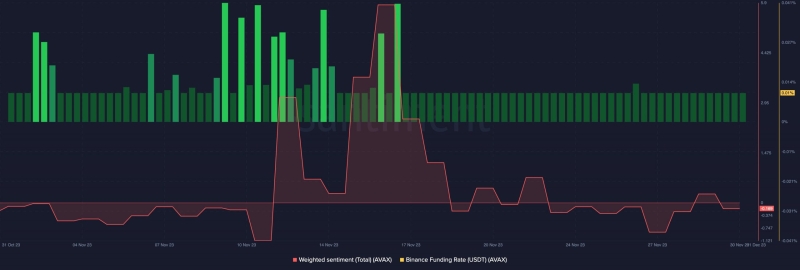

Regardless of the negative sentiment around AVAX, traders are betting on the token price to increase.

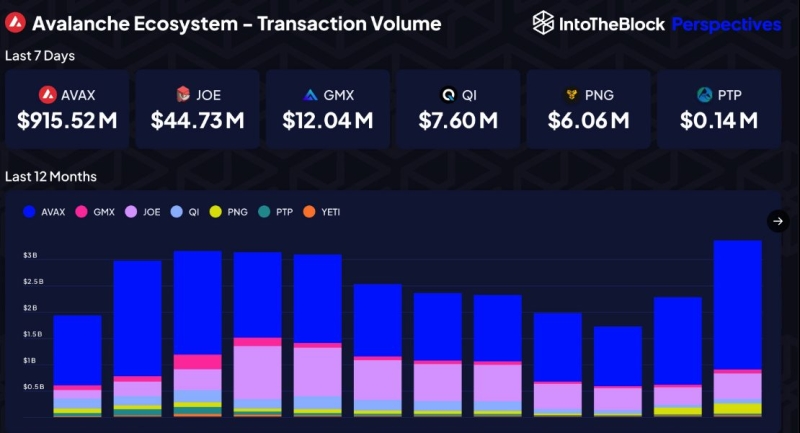

- Neither Trader Joe nor GMX had a higher trading volume than AVAX.

- AVAX has a more even distribution among whales and retail holders than the others.

The month of November proved to be vital for the Avalanche [AVAX] ecosystem. To a great degree, the transaction volume on the blockchain was unimpressive in October.

But as the 11th month began, volume skyrocketed, and by the second week, the volume reached heights it had not touched since May 2022.

No token edges out the flagship

Details from IntoTheBlock revealed a surge in activity involving tokens operating on the Avalance blockchain was responsible for the hike in volume.

Apart from AVAX, two other notable cryptocurrencies that influenced the increase were Trader Joe [JOE] and GMX. However, despite their contributions, the native token AVAX still had the highest transaction volume.

AMBCrypto, with data provided by IntoTheBlock, also considered how the tokens compared in terms of holders in profits. At press time, AVAX’s price was $22.43. This value represents a 100% increase in the last 30 days.

JOE also jumped within the same period with a 53.05% increase. GMX, at $50.39, implies that the value increased by 12.50%. As a result, AVAX could boast of having 66% of its holders in profit.

The price increase of GMX and JOE also increased the profit ratio of holders. But both still had most holders below the break-even point.

In terms of the number of addresses, AVAX also leads. At the time of writing, there were 6.03 million AVAX holders.

Trader Joe ranks with a meager 112,000 holders while other tokens on the Avalanche ecosystem were far below JOE’s and AVAX’s numbers.

AVAX spreads its wings across all ends

Despite AVAX’s 100% price increase, the Weighted Sentiment around the cryptocurrency dropped. At press time, the metric was down to -0.169. Weighted Sentiment measures the positive/negative commentary about a project using social data.

When the metric is positive, it means that market participants are optimistic about an asset’s performance. So, the decrease means that traders were no longer bullish on AVAX’s short-term price action.

Regardless of the sentiment, traders are betting on an AVAX price increase. This was indicated by the funding rate which was 0.01% at the time of writing.

Additionally, AVAX did not beat other tokens in terms of whales’ concentration. According to IntoTheBlock, the token had a somewhat even distribution among its holders, noting that:

“AVAX shows the lowest whale concentration among top Avalanche ecosystem assets with 43.15%, followed by QI and YETI. AVAX’s lower concentration suggests a more distributed and potentially stable investor base.”

This data implies that both retail holders and deep-pocket investors have AVAX on their radar. As it stands, AVAX’s price may decrease. But in the long term, the token remains one to keep an eye on.