BTC price action stays firmly within an established range, while analysis shows that overall Bitcoin investor composition is changing.

Bitcoin (BTC) stuck to $26,500 into the Sept. 24 weekly close as exchange trader accumulation continued.

Analysis: BTC price “not ready to make a move”

Data from Cointelegraph Markets Pro and TradingView showed BTC price stability holding firm over the weekend.

Bitcoin had delivered a cool end to the Wall Street trading week, having also shaken off macroeconomic volatility catalysts from the United States.

With few cues appearing since, popular trader and analyst Credible Crypto eyed a slow build-up to a trend shift on the Binance order book.

“Looks like we are not ready to make a move yet,” he summarized to X (formerly Twitter) subscribers on the day.

$BTC Aggregate CVDs & Delta

loading the sunday liquidity hunt… pic.twitter.com/qFD1dtDGHO— Skew Δ (@52kskew) September 23, 2023

Further subtle order book changes were noted by Keith Alan, co-founder of monitoring resource Material Indicators, who spied on bid liquidity moving higher toward spot price.

Looks like the #BTC bid liquidity at $26.2k turned into a market order.#FireCharts pic.twitter.com/zJCTafttNK

— Keith Alan (@KAProductions) September 24, 2023

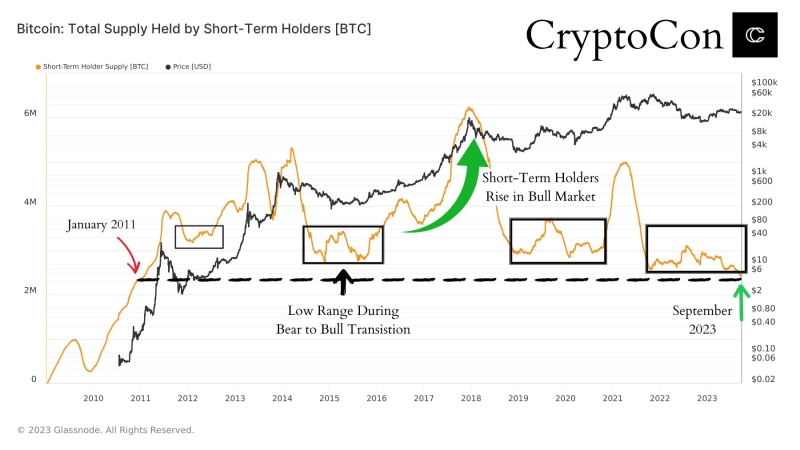

BTC short-term holder reduced to “fine powder”

Picking up on active Bitcoin market participants, popular trader and analyst CryptoCon noted a major washout of speculators.

Short-term holders (STHs), the cohort of Bitcoin investors who have held their coins for 155 days or less, now control less of the available BTC supply than at any point in over a decade.

Highlighting data from on-chain analytics firm Glassnode, CryptoCon described STH holdings as a “fine powder.”

“In other words, there are more strong Bitcoin holders than ever before!” part of commentary added.

Previously, Cointelegraph reported on the implied losses currently being endured by the remaining STH investors.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.