BTC price starts the celebrated month of “Uptober” with a trip past $28,000, but the question on everyone’s lips is whether Bitcoin can hold its ground.

Bitcoin (BTC) starts a new week, a new month and a new quarter with a firm bullish move past $28,000.

The largest cryptocurrency greets “Uptober” in style with its best weekly close since mid-August — what lies in store next?

After mixed BTC price action in September, market participants were prepared for a potentially volatile monthly close, but in the end, this ended up in the bulls’ favor.

With October frequently the sight of tangible BTC price gains, excitement is brewing over what might happen in the coming weeks.

Macro triggers may not hold the answer immediately, as October begins with a quiet phase for United States macro data and the government averting a shutdown at the last minute.

Bitcoin fundamentals are not yet echoing the spike in spot price, with mining difficulty due to decrease at its next automated readjustment on Oct. 2.

Cointelegraph looks at these topics and more in the weekly digest of BTC price catalysts lying in wait.

Bitcoin bulls acknowledge BTC price reversal risk

In the run-up to the Oct. 1 weekly close, Bitcoin had already cleared the end of the September monthly candle with little overall volatility.

That all changed as the week ended, with a sudden growth spurt taking BTC price action to just shy of $28,000. In the hours that followed, new local highs of $28,451 appeared on Bitstamp.

Since the start of Oct. 1, the largest cryptocurrency is up over 5%, data from Cointelegraph Markets Pro and TradingView confirms.

The move provided Bitcoin’s highest weekly close since mid-August, canceling out the weaker performance seen since.

“Bitcoin back up to $28,000,” Michaël van de Poppe, CEO and founder at MNTrading, told X (formerly Twitter) subscribers on the day.

$BTC Aggregate CVDs & Delta

Mostly seeing sell pressure just in perps for nowPrice decline with Perp CVD decline & Perp sell delta picking up

Next move that decides fate of this entire move is spot pic.twitter.com/7mAB2XMvUh

— Skew Δ (@52kskew) October 2, 2023

Keith Alan, co-founder of monitoring resource Material Indicators, posted a snapshot of the Binance order book, showing $28,000 as the main hurdle to overcome just after the move.

Bitcoin, he added, was now contending with resistance in the form of the 200-week moving average at $27,970.

“Expecting another run at resistance this month, but since I’m still in ‘Buy the Dip, Sell the Rip Mode’ I’m going to stick to those rules, take the quick money and look for the next setup,” part of accompanying commentary read.

Happy Uptober to those who celebrate.

Remember 2021? pic.twitter.com/qgHy1ThGOf

— The Wolf Of All Streets (@scottmelker) October 2, 2023

Popular trader Jelle went further, suggesting that Bitcoin was in the midst of a more significant trend change.

“Bitcoin broke its mid-term downtrend, retested it, and is now starting the next leg higher,” he proclaimed alongside an explanatory chart.

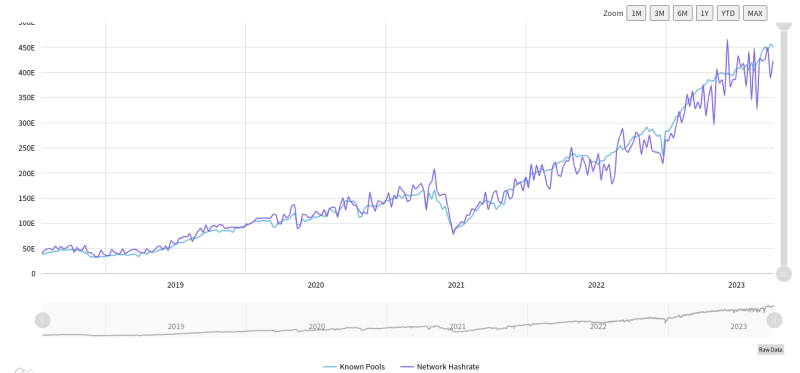

Hashrate follows price. Some folks believe price follows hashrate, possibly because hashrate doesn't simply track ~spot~ price, but rather tracks some ~speculative~ future price. Miners are speculators too!

— Jameson Lopp (@lopp) June 23, 2018

In a blog post released at the weekend, Lopp unveiled the results of his efforts to predict hash rate more accurately.

“By blending together many hashrate estimates and weighting them based upon recent estimates with a variety of trailing data time frames we were fairly easily able to improve upon the 1100 block estimate and decrease the average error rate by 13% and lower the standard deviation by 14%,” he summarized.

Depending on the resource used, hash rate values can differ considerably, with only the broad trend clearly visible to observers.

Fed speakers headline macro diary

While Bitcoin gets excited into the first week of October, the same cannot be said for United States macro data, which is due a calmer start to the month.

The main would-be event of the week has arguably already occurred, as lawmakers averted a government shutdown at the last minute.

Ukraine aid formed the sticking point, with this being removed to strike a deal in Congress.

Turning to the month’s outlook, the financial commentary resource The Kobeissi Letter focused on forthcoming commentary from officials at the Federal Reserve.

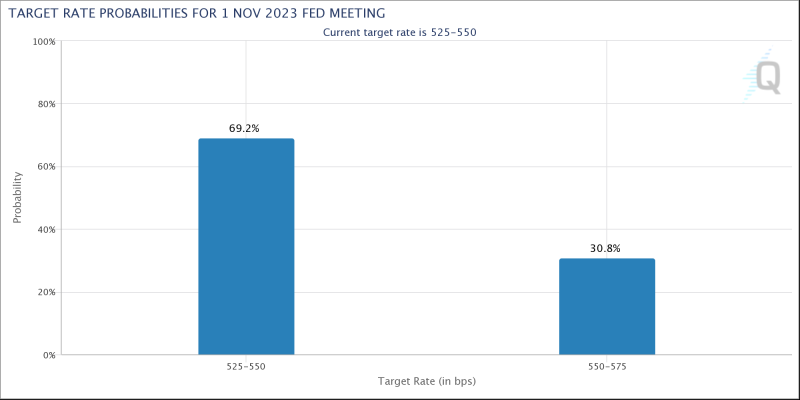

Ahead of the next Federal Open Market Committee (FOMC) meeting to decide interest rate policy on Nov. 1, markets will continue to eye official language for clues.

“The next Fed meeting is in exactly one month. With 13 Fed speakers this week, we expect even more volatility,” Kobeissi summarized on X.

The next Fed meeting is in exactly one month.

With 13 Fed speakers this week, we expect even more volatility.

We're publishing our trades for the week shortly.

In 2022, our calls made 86%.

Subscribe to access our analysis and see what we're trading:https://t.co/SJRZ4FrfLE

— The Kobeissi Letter (@KobeissiLetter) October 1, 2023

The latest data from CME Group’s FedWatch Tool shows mixed feelings over what the FOMC will decide. The market currently puts the odds of rates remaining at their present levels at 62%.

Analysis turns positive on dollar liquidity

Eyeing an associated macro phenomenon, meanwhile, financial commentator Tedtalksmacro pointed to U.S. liquidity trends and their impact on BTC price action going forward.

The relationship between global liquidity and risk asset performance is well documented — especially given the fluctuations occurring since the outbreak of the COVID-19 pandemic.

Late last week, Tedtalksmacro showed a divergence between net U.S. dollar liquidity and BTC/USD.

Yes pic.twitter.com/cgzD5OoeKa

— tedtalksmacro (@tedtalksmacro) September 29, 2023

In the accompanying analysis, he argued that measuring delta over “outright liquidity” gave better insight. Regarding the outlook for Bitcoin, he was complimentary.

“Most importantly, the path of least resistance is now sideways / higher from here in the years to come… but substantial risk remains ( for at least a few quarters ), that you get chopped up before things rip quickly higher,” he wrote.

Measuring liquidity outright is not so useful for informing investment decisions and tends to lag, however, measuring the delta or change week-on-week, month-on-month is much more powerful.

As there is often a lead on the liquidity side, at least when comparing with BTC price… pic.twitter.com/1DvE7xInxC

— tedtalksmacro (@tedtalksmacro) September 29, 2023

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.