Bitcoin stays frustratingly quiet after the weekly close, but BTC price forecasts are giving ever-shorter breakout deadlines.

Bitcoin (BTC) is painting a classic August picture as it starts the new week — volatility is nowhere to be seen.

In a continuation of some of the quietest BTC price action ever seen, the largest cryptocurrency remains locked in a narrow trading range below $30,000.

Whether it be long or short timeframes, Bitcoin is giving market observers cause for increasing frustration. Despite a tug-of-war between bulls and bears on exchanges, neither party seems able to set a new BTC price trend in motion.

Will the status quo remain this week?

With few macroeconomic triggers in store, catalysts for change will need to come from elsewhere. Whales are accumulating, data suggests, fueling an argument that Bitcoin is preparing its next major breakout phase in classic style.

A similar conclusion comes from some of the narrowest volatility recorded for Bitcoin courtesy of the Bollinger Bands metric, with current conditions rivalling September 2016 and January 2023.

By definition, it may simply be a matter of time before history repeats itself.

Bitcoin copycat move begins new rangebound week

The weekly close saw a modicum of volatility return to Bitcoin spot price performance, but just like last week, this was short lived.

Following the new weekly candle open, BTC/USD dipped to test $29,000 before returning to its previous position — one that still holds at the time of writing, data from Cointelegraph Markets Pro and TradingView shows.

Michaël van de Poppe, founder and CEO of trading firm Eight, noted the similarities while repeating his view that $29,700 is the level for bulls to reclaim.

Over the weekend, van de Poppe described the lack of volatility overall as “extremely astonishing.”

“The classic dump on Sunday evening took place on Bitcoin,” he told X subscribers alongside a chart showing relevant areas of interest.

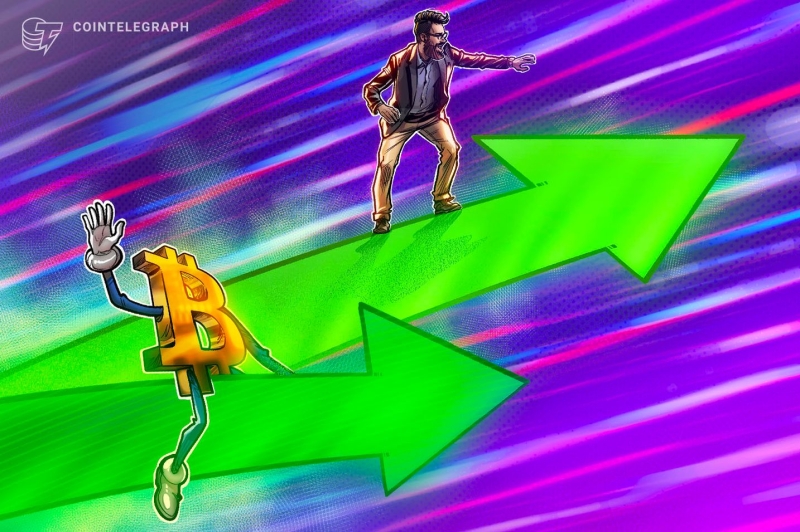

“Strong start off the cycle bottom, now in re-accumulation mode,” on-chain and cycle analyst Root continued, pointing to realized price figures.

Bitcoin’s realized price refers to the aggregate price at which the BTC supply last moved.

Fed FOMC minutes lead cool macro week

Crypto markets are in for a relatively quiet macroeconomic data period, in line with the summer lull.

This week, while “big” for United States consumer data, has Federal Reserve minutes as its main highlight.

Key Events This Week:

1. July Retail Sales data – Tuesday

2. Building Permits data – Wednesday

3. Fed Meeting Minutes – Wednesday

4. Initial Jobless Claims – Thursday

5. Philly Fed PMI data – Thursday

6. Retail earnings including $WMT $TGT $HD

Big week for consumer data.

— The Kobeissi Letter (@KobeissiLetter) August 13, 2023

Those minutes will show the attitudes of Federal Open Market Committee (FOMC) members toward interest rate policy as they were when rates were hiked last month.

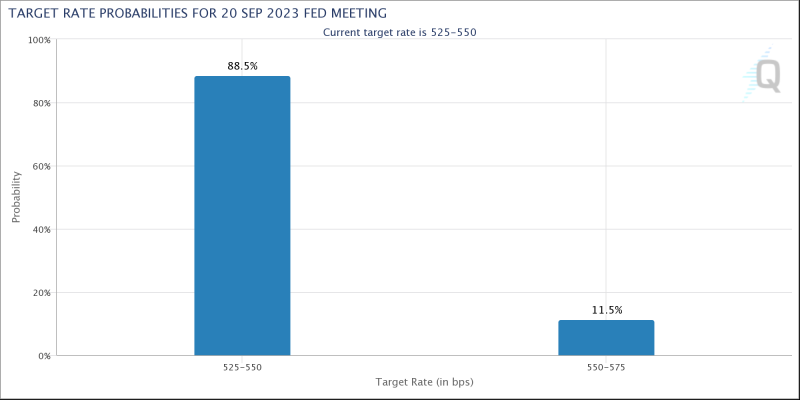

Risk asset traders continue to look toward the September FOMC meeting for a potential rate hike pause — something which should benefit crypto as well.

According to CME Group’s FedWatch Tool, the odds of that happening stand at almost 90%, with the meeting still over a month away.

Any knee-jerk BTC price reaction to this week’s data printouts, meanwhile, arguably looks unlikely — last week’s more significant releases failed to move markets.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.