10 Years of Decentralizing the Future

May 29-31, 2024 – Austin, TexasThe biggest and most established global hub for everything crypto, blockchain and Web3.Register Now

Bitcoin (BTC), ether (ETH), sol (SOL) and many major altcoins began the Asia trading day in the red as the week opened with volatility.

Bitcoin was down as low at 5% over a 24-hour period, trading at $41,300, before recovering to $42,000, according to CoinDesk Indices data. Ether hit a low of $2,170 before climbing back up to $2,239. Solana was down to $66 before climbing back to $70. Most of these losses took place within the last 90 minutes, as of press time.

The CoinDesk Market Index (CMI) is down 4% to 1,743.

Coinglass data shows that there had been over $335 million in liquidations over the last 12 hours with $300 million in long positions getting liquidated.

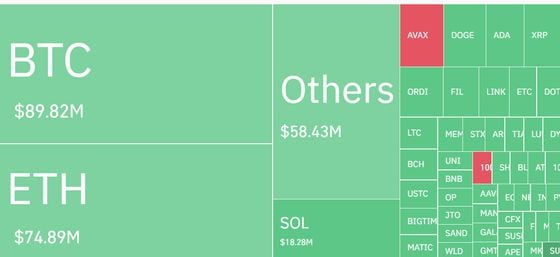

Bitcoin and Ether lead the way in the liquidation heatmap with over $89 million in bitcoin positions getting liquidated and $74 million in ether.

On-chain analyst Willy Woo wrote on X that the market may see a correction in bitcoin prices down to $39,700.

The Bitcoin CME Gap at 39.7k refers to a situation where bitcoin’s price on the Chicago Mercantile Exchange jumped, leaving a gap at $39,700, and historically, such gaps usually get filled, meaning the price often returns to this level. Price gaps in the CME futures market for bitcoin occur due to its hours of operation being aligned with U.S. trading hours, leading to potential price differences at market open and close.

Edited by Nikhilesh De.