10 Years of Decentralizing the Future

May 29-31, 2024 – Austin, TexasThe biggest and most established global hub for everything crypto, blockchain and Web3.Register Now

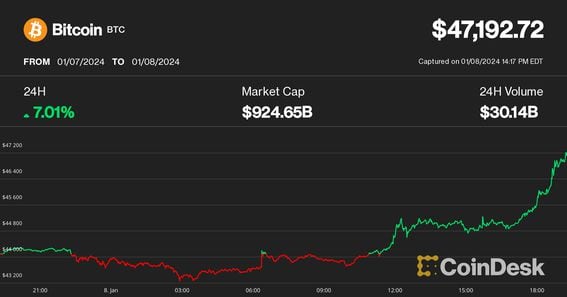

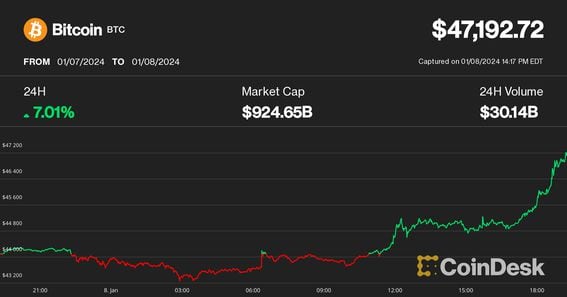

Bitcoin (BTC) on Monday topped $47,000 for the first time since April 2022 as anticipation for a landmark spot-based BTC exchange-traded fund (ETF) approval in the U.S. is reaching a fever pitch.

The largest and original cryptocurrency rose sharply from $43,200 during Asia morning hours to a fresh 19-month high of $47,192 during the U.S. trading session, CoinDesk Indices data shows. BTC gained almost 7% over the past 24 hours.

For full coverage of bitcoin ETFs, click here.

The rally happened as investors are anxiously awaiting a regulatory decision for the first spot-based bitcoin exchange-traded-funds in the U.S., expected sometime this week. Most market observers expect an approval, with bulls forecasting that these vehicles would dramatically expand the investor base for the asset and attract large inflows.

Applicants including asset management giants BlackRock, Fidelity and Grayscale earlier today submitted updated S-1 filings to the U.S. Securities and Exchange Commission (SEC) and multiple issuers revealed the fees they would charge investors.

In case an SEC approval truly arrives, the announcement could push bitcoin’s price even higher, LMAX Group market strategist Joel Kruger noted in an email.

“An approval could trigger a 10-15% rally, fueled by sidelined capital,” Kruger said. “If there’s no approval, projections hint at a possible correction, but strong support above $30,000 is expected.”

Edited by Nick Baker.